- Does Apple pay a dividend? Yes, it has paid quarterly dividends for the last 14 years. Apple’s dividend yield is currently 0.38%. In 2025, shareholders received $1.03 per share.

- Compared to stocks in sectors such as utilities or REITs, Apple’s dividend stock provides investors with a lower cash flow. The company is focused on further business and capitalization growth.

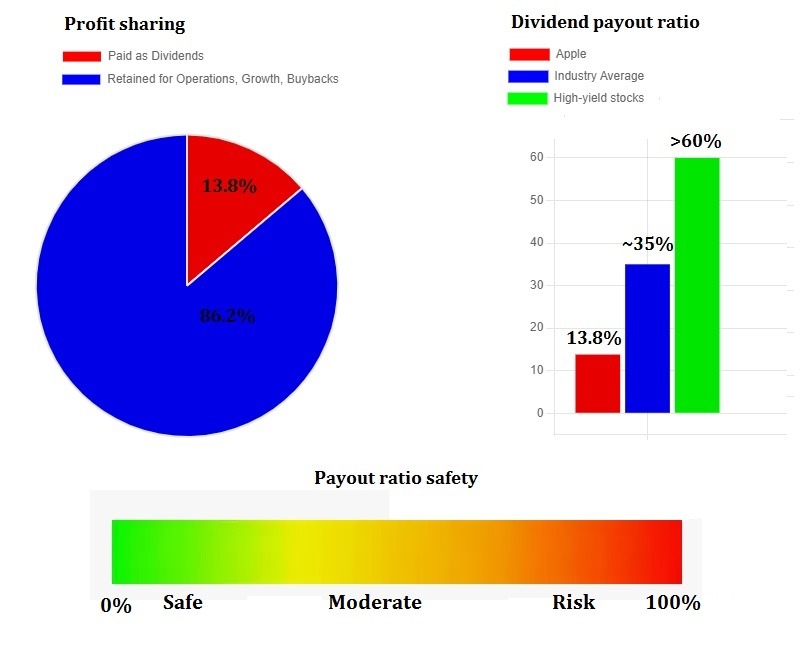

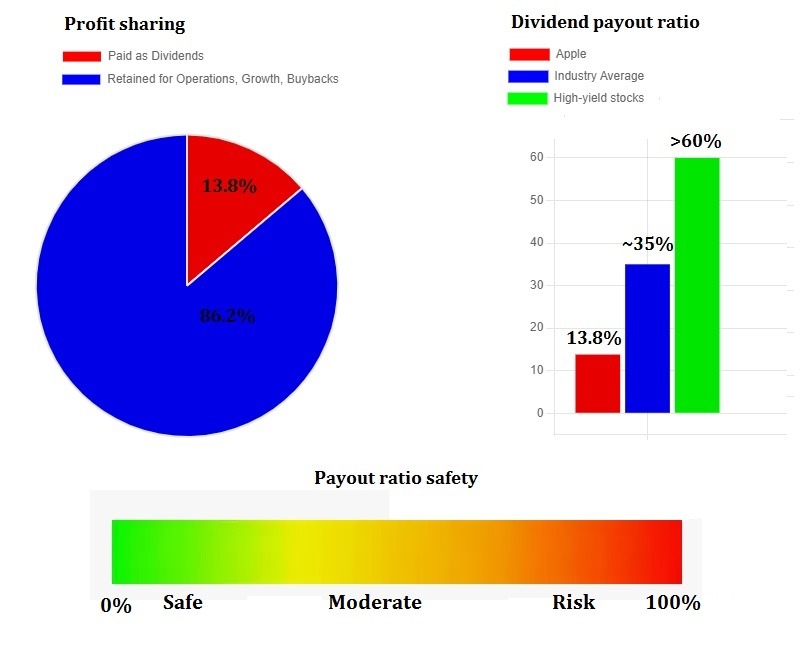

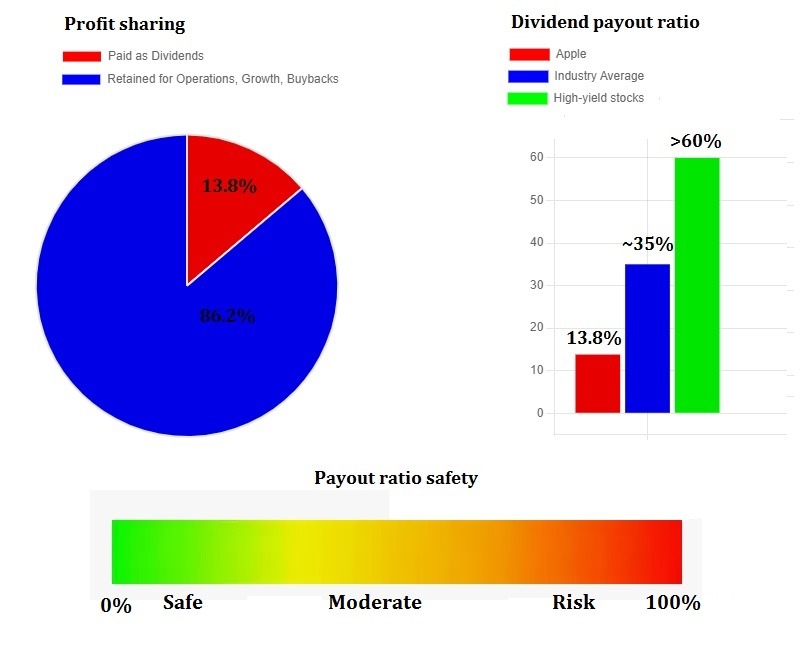

- The AAPL dividend analysis shows that the company has increased its dividends for 14 consecutive years (adjusted for the stock split). With a conservative payout ratio of 13.8%, there is high potential for further dividend increases.

The facts listed make the company attractive to investors focused on both capital growth and cash flow. In this article, we will explore whether Apple is a dividend-paying stock and discuss the investment strategy for which AAPL dividends are suitable.

Table of Contents

Direct Answer: Yes, Apple Pays Quarterly Dividends

Does Apple pay a dividend? Yes, it does. Here are some key facts about AAPL dividend payments:

- payment frequency – quarterly;

- size of Apple’s quarterly dividend – $0.26;

- Apple’s dividend yield – 0.38%;

- consecutive years – 14 years.

The company resumed paying dividends in 2012, after a break of 17 years.

Although Apple is a growth company, it provides its shareholders with a modest but steady cash flow. This sets it apart from many other companies in the technology sector.

For example, companies such as Netflix Inc. (NFLX) and Amazon.com Inc. (AMZN) do not pay dividends at all. Then there are companies like Alphabet Inc. Class A (GOOGL) that lack a long dividend history.

Apple’s Current Dividend Metrics and Payment Details

Let’s take a look at how much dividend Apple pays:

- During the 2025 financial year, the company distributed more than $15.4 billion to its shareholders.

- Apple’s dividend per share (TTM) – $1.03. Forward dividend – $1.04 ($0.26 x 4).

- At a share price of $272.19, Apple’s dividend yield stands at 0.38%.

Apple’s market capitalization exceeds $4 trillion. According to this metric, the company is the second largest in the world.

Current Dividend Yield and Calculation

The following formula is used to calculate Apple’s dividend yield percentage:

Dividend Yield = (Annual Dividend ÷ Share Price) x 100%

At the time of writing, Apple’s dividend yield stands at 0.38%. This is lower than the S&P 500 index’s average dividend yield of around 1.2%.

This metric is also significantly lower than the average yield of ‘traditional’ dividend stocks. Companies that attract the attention of US income investors typically offer yields of between 3% and 6%.

In terms of current Apple’s yield, Apple lags behind around 80% of companies worldwide. This is because the company prioritizes business growth and share buybacks.

The table below provides an example of a dividend calculation based on investment size.

| Number of Shares | Investment Size | Annual Dividend | Quarterly Payment |

| 100 | 100 × $272.19 = $27,219 | 100 × $1.04 = $104 | $26 |

| 500 | 500 × $272.19 = $136,095 | 500 × $1.04 = $520 | $130 |

| 1000 | 1000 × $272.19 = $272,190 | 1000 × $1.04 = $1040 | $260 |

According to data from Investing.com, the consensus forecast for Apple’s stock price over the next 12 months is an increase of 5.93%. Analysts also expect Apple’s quarterly dividend to rise in Q2 2026. Therefore, the potential total return over 12 months exceeds 6.3%.

Payment Schedule and Ex-Dividend Dates

When does Apple pay dividends? According to Apple’s dividend quarterly payment schedule, shareholders receive money four times a year. These payments usually occur in February, May, August and November.

The first Apple’s ex-dividend date in 2026 is scheduled for Monday, February 9. To receive the upcoming dividend, investors need to become owners of the shares before this day. With the T+1 settlement cycle, the last day to purchase shares is February 6 (Friday).

According to the Investor Relations section of the company’s official website, dividend payments from AAPL usually occur three to five days after the record date.

Dividend Amount Per Share Analysis

In 2012, Apple’s dividend per share was $2.65 per quarter. Adjusted for two subsequent splits, this equates to a payment of $0.09 per share. By the end of 2025, the quarterly dividend payment had increased to $0.26 per share. The company’s metrics are as follows:

- CAGR 3Y – 4.60%;

- CAGR 5Y – 5.43%;

- CAGR 10Y – 7.93%.

Apple has maintained its commitment to increasing shareholder returns, even during the pandemic. However, the annual dividend amount is growing more slowly than that of most other mature companies in different economic sectors.

Apple vs Tech Sector Dividend Comparison

Let’s conduct Apple’s dividend comparison with tech stock dividends and income stock dividends. The most frequent choice facing income investors in the technology sector is the Apple vs. Microsoft dividend alternative.

Microsoft vs Apple Dividend Strategy

A comparison of MSFT vs. AAPL dividend yield shows a difference of almost 2x (0.75% and 0.38%, respectively). However, it cannot be said that the companies belong to different categories. Both are primarily focused on business growth and development rather than providing a high dividend yield.

The table below shows an Apple dividend vs Microsoft dividend comparison based on various other parameters.

| Parameter | Apple | Microsoft |

| Payment frequency | Quarterly | Quarterly |

| Payout ratio | 13.8% | 24.08% |

| Growth streak | 14 | 21 |

| 5Y Dividend Growth | +30 % | +53% |

For Microsoft, around three weeks pass between the ex-date and the payment date. Shareholders typically receive money in March, June, September and December.

When does Apple pay dividends? The company’s payment dates fall in February, May, August, and November. Therefore, investors do not always have to choose between Apple vs. Microsoft dividend.

Both companies can be added to a portfolio to provide cash flow in different months. However, it is important to keep an eye on the weighting of the technology sector in the portfolio.

Tech Sector Dividend Landscape

Technology sector dividends are traditionally lower than those of more established companies. How much dividend does Apple pay? Its forward annual dividend is $1.04, giving it a forward yield of 0.38%.

According to Koyfin.com, Apple sits near the bottom of the tech dividend stocks ranking. In terms of dividend size, the company outperforms only 18% of companies in the same sector.

Examples of major technology companies with higher dividend yields:

- Texas Instruments Inc. (TXN) – 3.22%;

- IBM (IBM) – 2.23%;

- Cisco (CSCO) – 2.09%.

However, some companies in the technology sector do not pay any dividends. Amazon (AMZN) and Tesla (TSLA), for example.

Investors often ask, ‘Should I buy Apple’s stock for dividend income?’ It is not advisable to purchase this stock solely for its dividends.

Apple’s dividend yield is below average at around 1.2%, which is in line with the sector and the S&P 500 index. However, this stock has the potential to deliver capital growth alongside modest passive income.

Growth vs Income Stock Classification

‘Is Apple a dividend stock?’ Apple’s investment classification is a growth stock with a dividend. Its primary focus is capital appreciation. Investing in this company primarily offers the prospect of capital growth, with modest dividend income as a secondary outcome. Therefore, it is suitable for investors who are focused on capital growth and future passive income.

The matrix below classifies stocks by investment category.

The ‘High Yield, Low Growth’ category comprises stocks with a dividend yield of over 6%. The ‘Low Yield, High Growth’ category comprises growth companies, including Apple. Its typical dividend yield is below 1%.

‘High yield, high growth’ is a rare category, encompassing only a few companies in the technology sector. One example is HP Inc. (HPQ), which has a dividend yield of 5.16% and has seen its share price increase by over 28% in the last 12 months.

The ‘Low Yield, Low Growth’ category usually comprises companies experiencing business difficulties. It is advisable to avoid investing in them under any circumstances.

Dividend Safety and Sustainability Analysis

One indicator of Apple’s dividend safety is its low dividend payout ratio. Furthermore, financial health and Apple’s dividend history – spanning 14 years of increasing payments – support Apple’s dividend sustainability.

Payout Ratio and Financial Health

The dividend payout ratio shows the proportion of profits paid to shareholders. It is calculated by dividing the annual dividend by the annual earnings. The inverse metric is the dividend coverage ratio.

The following gradations apply to average levels of the dividend payout ratio:

- below 40% – very safe;

- 40-60% – moderate risk;

- 60-80% – high risk;

- above 80% – very high risk.

Apple’s dividend payout ratio stands at 13.8%. Over 86% of the profit remains with the company to fund further business development and share buybacks. In the event of an earnings decline due to economic problems, Apple has a high safety margin to maintain the dividend amount.

The dividend coverage ratio exceeds 7.2. This suggests an ability to pay dividends that is well above average, as well as ample opportunities for reinvestment.

Indicators of the company’s financial stability:

- substantial cash reserves;

- strong free cash flow generation;

- debt-to-equity ratio below 1;

- diversified revenue streams.

Financial analysts unanimously rate Apple’s dividends as ‘highly sustainable’ based on these facts.

14-Year Dividend Growth Track Record

Apple’s dividend track record spans 14 years of uninterrupted growth. Over the last five years, Apple’s dividend growth rate has been 5.43% per year. The cumulative dividend increase amounts to 30%.

The most significant milestones in Apple’s dividend history since 2012 are as follows:

- 2012-2015 – a phase of active growth;

- 2016-2019 – moderate, steady growth;

- 2020 – maintaining dividend growth momentum during the COVID-19 pandemic;

- 2021-2025 – continued steady growth.

Apple’s dividend increase history is not the most impressive. In terms of the length of its consecutive shareholder return increases, the company lags behind Dividend Aristocrats. Nevertheless, Apple is on the dividend champions list and provides cash flow growth that outpaces inflation.

Economic Downturn Performance

Is Apple dividend safe during recession? Two facts confirm the dividend’s safety during an economic downturn. Firstly, Apple’s financial stability, and secondly, the company’s dividend growth through different phases of economic cycles.

Factors of recession resilience:

- Apple’s low dividend payout ratio (13.8%);

- the company’s strong balance sheet;

- a diversified product ecosystem that reduces the risk of profit decline;

- services revenue, which provides stable cash flow.

Apple’s dividend recession was not recorded during the 2022 economic downturn or amid the 2020 COVD-19 crisis.

Investment Strategy: Apple’s Role in Income Portfolios

Below, we will examine Apple’s dividend investment strategy and Apple’s dividend tax treatment. We will also discuss who passive income Apple stock is suitable for, as well as the optimal allocation for an Apple’s income portfolio.

Passive Income Generation Potential

Apple’s passive income is modest. The forward yield on AAPL dividends is just 0.38%. The table below shows how many Apple shares for dividend income you need to add to a portfolio.

| Annual Dividend Income | Number of Shares | Investment Amount |

| $50 | 48 | $13,065.12 |

| $250 | 241 | $65,597.79 |

| $500 | 481 | $130,923.39 |

| $2000 | 1923 | $523,421.37 |

This calculation is based on a share price of $272.19 and an anticipated dividend of $1.04.

Apple stock is not suitable for a dividend income strategy, as it does not provide the significant immediate income required. This asset does not generate enough cash flow to live off passive income.

For comparison purposes, the potential cash flow from alternative capital allocation options is shown below:

- high-dividend stocks – 5-8%;

- REITs – 6-10%;

- bonds – 4-6%.

Apple’s income generation may be of interest to investors who are focused on long-term wealth accumulation or capital appreciation rather than current income.

Growth and Income Balance

Apple’s total return comprises dividends plus stock price appreciation. The current dividend yield is 0.38%. According to the consensus analyst forecast, the potential growth over the next 12 months is 5.93%.

However, historical Apple stock price growth rates have reached 15% per annum. Therefore, long-term investors could see a total return that exceeds the average S&P 500 metric.

Apple stock is suitable for people with a balanced investment approach:

- they plan to purchase and hold assets long-term;

- they are focused on capital growth with a small income as a bonus;

- they are building retirement capital using tax-advantaged accounts (e.g., IRA).

Financial experts do not recommend relying solely on Apple stock for passive income, nor do they recommend allocating more than 5-10% of a growth portfolio to a single company.

Tax Considerations and Efficiency

AAPL dividends are suitable for various tax-efficient investment strategies. Apple’s dividend taxes depend on whether the dividends are qualified and the investor’s tax bracket.

Apple meets the IRS requirements for the source of payments. Therefore, qualified dividend status depends on how long the stock is held for.

In order to qualify for the tax benefit, shares must be held for at least 61 days. This specified period must fall within a 121-day window starting 60 days before Apple’s ex-dividend date.

The table below shows the long-term capital gains tax rates for 2025. These rates depend on the investor’s income and filing status. Qualified dividends are taxed at the same rates.

| Tax rate | Singles | Joint-married filers | Married filing separately | Head of household |

| 0% | up to $48,350 | up to $96,700 | up to $48,350 | up to $64,750 |

| 15% | $48,351 – $533,400 | $96,701 – $600,050 | $48,350 – $300,000 | $64,751 – $566,700 |

| 20% | $533,401 or more | $600,051 or more | $300,001 or more | $566,701 or more |

Another strategy for optimizing tax on investment income, including dividends, is to use tax-efficient accounts.

- traditional IRA and 401(k) provide tax deferral until funds are withdrawn;

- Roth IRA and 401(k) completely exempt investment income from tax.

Future Outlook and Dividend Growth Prospects

Let’s consider the likelihood of a future Apple’s dividend increase. Analysts believe that future dividend growth is justified by strong business performance and management policies that prioritize shareholder interests.

The key arguments are Apple’s low dividend payout ratio and the expected growth in the company’s earnings. Based on these facts, experts provide a positive Apple’s dividend forecast.

Business Fundamentals Supporting Dividends

The company’s financial score of 95 points, corresponding to the ‘Very safe’ level, is based on its Apple’s cash flow, dividend assessment and other metrics.

The company’s cash flow for the 2025 financial year totalled $98.8 billion. Meanwhile, only $15.4 billion was allocated to dividends. The dividend coverage ratio exceeds 6.4.

Among the positive factors are the company’s business model supporting dividends and Apple’s high earnings dividend coverage ratio. The stability of the business model is underpinned by the following strengths:

- a diversified portfolio of revenue-generating products (e.g. iPhone, Mac, iPad, wearables);

- growing services revenue;

- a subscription ecosystem (e.g. Apple One, iCloud, Apple Music);

- global market presence, which reduces geographic risks.

Analyst Projections and Market Expectations

Over the last 12 months, Apple’s dividend per share has increased by 4.04%. The expected dividend growth rate is 4-6% in 2026. In the long term, analyst dividend predictions promise a sustainable growth trajectory with an average annual rate of 4-5%.

The positive Apple’s dividend forecast is based on the following facts:

- steady earnings growth;

- expansion of offered services;

- introduction of new innovative products;

- geographic market expansion.

The Apple’s dividend forecast also accounts for potential risks:

- a decline in consumer spending due to an economic downturn;

- pressure from regulators (especially the EU/China);

- competition in key markets;

- potential supply chain disruptions.

For this reason, analysts do not expect Apple to increase its annual dividend growth rate.

How to Invest in Apple for Dividends

Let’s look at how to buy Apple Inc. (AAPL) stock to receive dividends. One of the key components of this strategy is Apple dividend reinvestment. On investment platforms, Apple is listed under the ticker symbol AAPL. The company’s shares trade under this ticker on the NASDAQ exchange.

Optimal Purchase Timing and Ex-Dividend Strategy

The timing of Apple’s purchases depends on its strategy. In general, three approaches to identifying the optimal time for a transaction can be identified:

- The strategy involves buying Apple before the ex-dividend date and selling them shortly afterwards. This investment strategy is known as the Apple dividend capture strategy. When using this strategy, it is important to consider transaction fees, the drop in the stock price at the market open on the ex-date and the lack of a tax benefit due to the short holding period.

- Buying on the ex-date secures the most favourable entry point. On this day, the stock price usually falls by a sum similar to the size of the dividend.

- The long-term ‘buy and hold’ strategy. With this approach, investors do not focus on minor price fluctuations, instead buying shares at convenient intervals with the intention of owning the asset for many years.

Of the options available, the last one appears to be the most preferable for Apple stock. This option offers the opportunity to benefit from price appreciation and passive income. Investors also receive benefits in the form of reduced tax rates on qualified dividends and long-term capital gains.

The first two strategies considered may not be suitable for Apple because the dividend size is small. However, this is not an individual investment recommendation.

Dividend Reinvestment Options

Automatic dividend reinvestment is a great way to save time and maintain financial discipline. However, there is no direct DRIP for Apple stock. The company does not offer such a program.

However, you can set up an Apple dividend reinvestment plan with most brokers. Examples include Fidelity, Charles Schwab, E*TRADE and Robinhood. Online brokers often offer dividend reinvestment without commission and with the ability to purchase fractional shares. An alternative to a dividend reinvestment plan is to buy new shares manually after funds have been deposited into the account.

Thanks to reinvestment, the effect of compound interest occurs. This provides the following advantages:

- increased cash flow due to a growing number of shares;

- the ability to buy even more shares thanks to the increasing cash flow;

- exponential capital growth over several decades.

One of the key factors in long-term wealth building is a dividend reinvestment plan.

Conclusion: Apple Dividends in Your Investment Strategy

As an Apple dividend conclusion, let’s answer the main question: ‘Does Apple pay dividends?’ Yes, the company pays its shareholders four times a year. How much dividend does Apple pay? At the end of 2025, Apple’s quarterly dividend was $0.26 per share. Over the course of 2025, shareholders will have received $1.03 per share.

Experts rate the safety of Apple’s dividend highly. The main reasons for this are the strength of its business and its low dividend payout ratio of 13.8%.

When making an Apple investment decision, it is important to bear in mind that this asset offers a combination of modest regular income and high growth potential over several years.

Another common question from novice investors is: ‘Should I buy Apple stock for dividend income?’ The answer is no, if that is your only investment goal.

AAPL dividends do not align with the investment strategy of those seeking a high passive income to cover current expenses and other needs. Apple dividend vs Microsoft Corporation dividend comparison shows that, even among its main competitors, Apple is not the highest payer. Mature companies provide shareholders with an even greater cash flow.

Who should buy Apple dividend stock? The company’s shares are ideal for investors seeking capital growth. However, before adding them to a portfolio, it is important to assess whether the company aligns with your investment strategy, and to consult with a financial advisor.

Frequently Asked Questions (FAQs)

Q1: Has Apple ever cut or suspended its dividend?

Yes, Apple stopped paying dividends in 1995 after eight years. However, it adopted a new dividend policy in 2012. Since then, the company has increased its dividends annually and has not reduced them.

Q2: What factors could impact Apple’s dividend payments?

Apple dividends could be negatively affected by factors such as regulatory risks and the loss of competitive advantages. There is also a possibility of reduced earnings due to economic downturns and falling consumer spending.

Q3: How many Apple shares do I need for meaningful dividend income?

Apple’s forward annual dividend is $1.04 per share. In order to generate a cash flow of $1,000 per year, an investor would need to own 962 shares in the company.

Q4: Will Apple increase its dividend in 2026?

According to analyst forecasts, Apple will increase its quarterly dividends in Q2 of 2026. In 2025, Apple’s dividend growth rate was 4.04%. Experts expect the payment amount to increase by 4-6% in 2026.

Q5: Does Apple’s dividend make it suitable for retirement portfolios?

Apple’s dividend safety is a compelling reason to add the company to a retirement portfolio. However, its dividend yield is significantly lower than the market and sector averages (0.38% versus 1.2%). Therefore, this stock is not suitable for a portfolio whose objective is to generate a high passive income.

Q6: How do Apple dividends compare to bonds for income?

Apple’s dividend yield at the end of 2025 was 0.38%. In comparison, the current yield of a 10-year US bond is 4.169%. Investment-grade corporate bonds can offer yields of over 5%.

Q7: What happens to Apple dividends during stock splits?

The dividend per share is adjusted according to the split ratio. The total amount received by each shareholder either remains unchanged or increases slightly. For example, the dividend was $3.29 per share in May 2014. After a 7-for-1 split, this became $0.47. In August 2020, shareholders received $0.82 per share, and after a 4-for-1 split, this figure decreased to $0.21.

Q8: Can I reinvest Apple dividends automatically?

Yes, reinvestment is possible. However, the company does not offer a direct DRIP. In order to reinvest Apple dividends automatically, you will need to arrange this with a broker. It is important to choose a broker that allows you to purchase fractional shares within a DRIP.