- Dividend growth investing enables you to create a stable source of passive income that grows over time.

- Investing in cheap dividend-growth stocks can increase both the average dividend yield and the total investment income of a portfolio.

- High-quality companies that have increased their dividends for decades demonstrate lower volatility than growth stocks. A long history of paying dividends to shareholders is a sign of financial stability and effective management.

- In 2025, the average dividend yield of the S&P 500 Index fell below 1.2%. Nevertheless, it was still possible to find affordable stocks with growing dividends on the stock exchange.

- Searching for undervalued dividend stocks combines the strategies of value investing and income investing.

This article will provide examples of the best cheap dividend stocks and explain the factors to consider when building a portfolio.

Table of Contents

What Makes Dividend-Growth Stocks Attractive Today

Cheap blue-chip dividend stocks are shares in quality companies whose market price is below ‘fair value’. The market undervalues them due to temporary problems affecting the company or industry. This can also be a consequence of an economic crisis.

However, these securities offer the same dividend growth stocks benefits. They provide investors with inflation protection through regularly increasing cash flow.

Before buying a cheap valuation stock, it is necessary to ensure that the company:

- Has economic moats. These significant competitive advantages allow it to maintain and grow its market share. They also enable it to pass on cost increases to consumers without risking reduced demand.

- Demonstrates financial stability. Primary attention is paid to fundamental metrics. These include the debt-to-equity ratio and the payout ratio, among others.

- Has a strong dividend track record, meaning it has consistently paid and increased dividends over several decades.

Cheap dividend stocks with high potential are shares in quality companies that are currently experiencing temporary difficulties. In the long term, however, they are characterized by low volatility and provide shareholders with cash flow, even during periods of crisis.

Top 10 Cheap Dividend-Growth Stocks to Buy Now

The table below shows undervalued dividend growth stocks.

| Name (Ticker) | Morningstar economic moat rating | Fair value according to Morningstar | Price to fair value | Forward dividend yield |

| Albemarle (ALB) | Narrow | 200 | 0.48 | 1.69% |

| Comcast (CMCSA) | Narrow | 49 | 0.6 | 4.4% |

| Eastman Chemical (EMN) | Narrow | 100 | 0.61 | 5.34% |

| Constellation Brands (STZ) | Wide | 225 | 0.63 | 2.88% |

| Fortune Brands Innovations (FBIN) | Narrow | 82 | 0.63 | 1.91% |

| Nike (NKE) | Wide | 104 | 0.66 | 2.34% |

| Elevance Health (ELV) | Narrow | 507 | 0.67 | 1.96% |

| MarketAxess Holdings (MKTX) | Wide | 260 | 0.67 | 1.76% |

| Brown-Forman (BF.B) | Wide | 40 | 0.71 | 3.19% |

| Omnicom Group (OMC) | Narrow | 115 | 0.72 | 3.56% |

The selection of cheap dividend stocks is based on Morningstar’s fair value estimates. The listed companies are included in the Morningstar US Dividend Growth Index. Given the selection criteria for this index, the provided list can be considered a selection of the best cheap dividend stocks 2025. However, this is not an investment recommendation. Let’s now take a closer look at each company.

Albemarle is a producer of specialty chemicals. Results for the period ending December 31, 2024 showed a decrease in revenue and a loss. According to experts, this is due to issues within the industry. As the external situation improves, so will ALB’s financial results. It tops the list of cheap dividend stocks in terms of undervaluation.

Comcast is a telecommunications company that has struggled to achieve further growth. However, experts rate its core business highly. These cheap dividend stocks have a payout ratio of 21.63%, indicating potential to maintain and increase dividends. Furthermore, despite virtually no change in revenue results for the second quarter 2025, the company’s net income increased by around 2.85 times compared to the same quarter last year.

Eastman Chemical is another company in the chemical sector. A 39.13% decrease in income per share for Q2 2025 was caused by a decrease in production volumes due to the economic downturn. Despite this, the company has no difficulty paying dividends. In terms of dividend yield, Eastman Chemical is the leader of the cheap dividend stocks list.

Constellation Brands is a producer of beer, wine and other alcoholic beverages. In early October, the company published its financial results for the second quarter of the 2026 fiscal year. These results showed a decrease in revenue and net income. However, Morningstar analysts predict that the company’s sales will return to average levels within a few years.

Fortune Brands Innovations operates within three segments: Water, Outdoor and Security. The company’s revenue is declining due to the slowdown in the housing and repair markets. Nevertheless, analysts believe that these cheap dividend stocks have good recovery potential. A moderate payout ratio will also help to preserve dividends during temporary difficulties.

Nike also experienced a decline in revenue and profit. The reasons for this are varied. These range from trade tariffs to strategic errors. One of the strong points of these cheap dividend stocks is their 23 consecutive years of dividend growth. Furthermore, payments increased by 8.11% over the past year, outpacing inflation.

Elevance Health is a leading company in the healthcare sector. Despite moderate expert forecasts for 2026–27, the company’s financial position is considered stable. A payout ratio of 27.72% also provides a safety margin for further dividend growth.

MarketAxess Holdings operates an electronic trading platform for corporate securities. Despite a decrease in net income, the company remains in a strong financial position. These cheap dividend stocks have generated passive income for over 40 consecutive years.

Brown-Forman is a company that produces and sells alcoholic beverages. Its economic potential is based on intangible assets, primarily related to premium products. Analysts expect demand to recover, largely due to increased demand from the elite segment.

Omnicom Group, a provider of advertising and digital marketing services, tops the list of cheap dividend stocks. In Q1 of 2025, the company experienced a decline in net income compared to the prior year’s fourth quarter. This negative trend continued in the following months. This affected the stock price. Nevertheless, the company continues to pay a quarterly dividend of $0.7.

Understanding the Morningstar US Dividend Growth Index

The Morningstar Dividend Growth Index is a good place to start when choosing which stocks to buy. It includes 397 companies. The securities included are selected based on the following characteristics:

- Dividend growth criteria. A company must have increased its dividends for at least five consecutive years. It is acceptable if a company did not increase dividends, but conducted a share buyback.

- Earnings forecasts. The index only includes companies with positive analyst expectations for net income.

- Payout ratio limits. In order to be included in the index, a company must have a payout ratio of less than 75%.

The resulting list excludes the top 10% of companies with the highest payout yields. This is done to reduce risk and increase growth potential. REITs (real estate investment trusts) are also excluded from the index, even if they meet the criteria.

Not all of the companies included in the Morningstar US Dividend Growth Index offer cheap dividend stocks. Some of them may be overvalued. Therefore, additional analysis is necessary when selecting individual securities. However, it is possible to invest in the entire index through the iShares Core Dividend Growth ETF (DGRO).

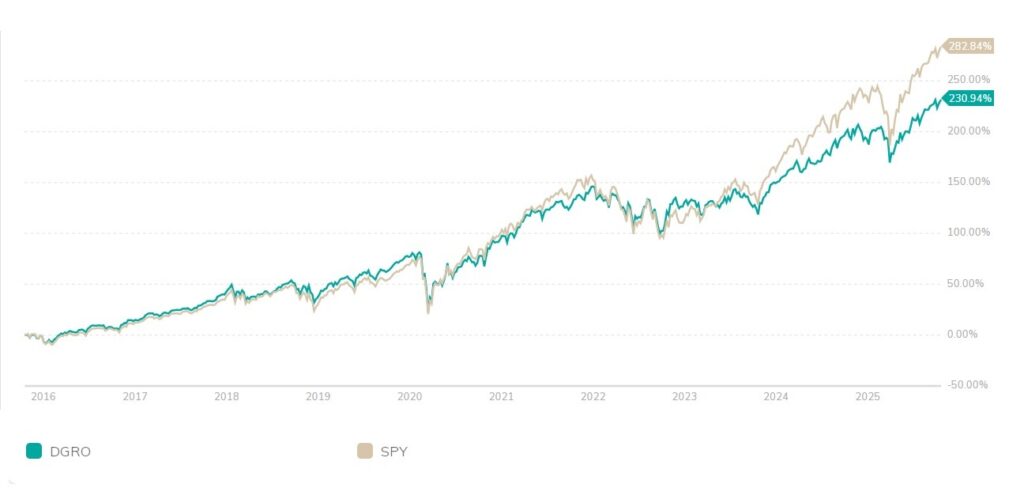

Take, for instance, the broad market. When compared to the S&P 500 ETF Trust (SPY), DGRO pays higher dividends. Its TTM dividend yield is 2.02%, compared to 1.08% for SPY. However, DGRO lags behind in terms of total return. The chart below illustrates the growth of a $10.000 portfolio over 10 years.

The Importance of Economic Moats in Dividend Growth Investing

Economic moats are significant competitive advantages that enable companies to demonstrate sustainable dividend growth. Examples include:

- network effect – the value of a product or service increases as its usage and customer base grow;

- switching costs – a customer will incur additional expenses (adjusted earnings) if they want to switch to a competitor;

- cost advantage – the company’s goods are cheaper to produce than those of its competitors.

Analysts use the term ‘narrow moat’ when they believe that a company will lose its key competitive advantages within ten years. ‘Wide moat’ indicates that a company’s advantages are likely to persist for at least 20 years.

High-Yield Dividend Growth Opportunities Under $10

Investors with limited funds often look for low-priced dividend stocks. Below is a list of high-yield dividend stocks that can also be considered affordable dividend stocks:

- Horizon Technology Finance (HRZN). The share price of this BDC (business development company) is $5.83. The dividend yield is 22.37%.

- Prospect Capital Corp (PSEC). The dividend yield is 19.7%, and the share price is $2.74. This is the cheapest dividend stock on the list.

- Orchid Island Capital Inc (ORC). This mortgage REIT offers a dividend yield of 19.65%. Its share price is $7.48.

- AGNC Investment Corp. (AGNC). The company is a mortgage REIT with a distribution yield of 14.5% and a share price of around $10.

- PennantPark Floating Rate Capital (PFLT). This BDC primarily works with private or low-liquidity public companies and focuses on floating-rate loans. The dividend yield is 14.44%. At the time of writing this review, the share price was $8.63.

- Barings BDC (BBDC). The company lends to businesses in the middle market. It pays out some of its interest income to shareholders. This equates to a yield of 12.37% based on a share price of $8.55.

- Huntsman Corp. (HUN). The chemical company’s stock costs just over $8, and its dividend yield is 12.17%.

- Western Union Co. (WU). The company specializes in international money transfers and provides financial services. Its dividend yield is 11.85%, with a share price of $8.16.

- Hooker Furniture Corporation (HOFT). Shares in this furniture manufacturer cost around $8.70. The dividend yield is 10.28%.

- Gladstone Land (LAND). This REIT owns agricultural land and farms. With a share price of around $9, the dividend yield stands at 6.19%.

All of the cheap dividend stocks under $10, listed above, have dividend yields above 5%.

Among cheap dividend stocks under $5, Oxford Square Capital (OXSQ) is worth noting. This stock is currently trading at $1.695. The annual dividend is 42 cents per share. This gives an impressive yield of 24.14%, making OXSQ the highest-yielding security in this review.

Cheap dividend stocks under $1 can be found on the over-the-counter market. One example is Chesapeake Granite Wash Trust (CHKR), which has a yield of 15.8% and is priced at $0.46 per share.

Monthly Dividend Stock Opportunities

In order to provide shareholders with a monthly income, a company must have predictable earnings. REITs and BDCs therefore dominate the monthly dividend stocks market.

There are more than 80 companies on the full list of those that pay their shareholders monthly. The cheapest monthly dividends are paid by the following companies:

- Pine Cliff Energy Ltd. (PIFYF) – 1.9% with a price of $0.52;

- Petrus Resources Ltd. (PTRUF) – 8% with a price of $1.13;

- Permianville Royalty Trust (PVL) – 4.5% with a price of $1.76.

When it comes to cheap monthly dividend stocks and high yields, the leaders are Oxford Square Capital (OXSQ), Horizon Technology Finance (HRZN) and Prospect Capital Corp (PSEC).

Risk Considerations and Red Flags

Making investments in cheap dividend stocks carries a high level of risk. This is particularly the case for securities with exceptionally high yields of over 10%. One way to reduce dividend risk is to invest in cheap dividend aristocrat stocks. However, it is important to remember that even the best companies may implement dividend cuts.

In order to avoid yield traps, it is necessary to carry out a financial health assessment of the company. This includes:

- studying the dividend payment history;

- payout ratio analysis;

- comparing the debt/equity ratio and key multiples with industry averages;

- evaluating the dynamics of revenue, cash flow, and net profit.

Good cheap dividend stocks have increased their dividends continuously for at least five years. Their payout ratio is less than 75%, and their debt-to-equity ratio is no higher than 2. Revenue and profit also show positive dynamics.

When it comes to BDCs or mortgage REITs, net interest income is also a key consideration. For REITs that own real estate, however, important metrics include net operating income, funds from operations (FFO) and property operating expenses.

Building a Diversified Dividend Growth Portfolio

Effective risk management is essential for investing in cheap dividend stocks. There are two factors that contribute to dividend portfolio diversification. The first is sector allocation. The second is combining cheap high dividend stocks with those that pay growing dividends.

To increase income stability, preference is given to cheap high quality dividend stocks. These are known as dividend champions and dividend aristocrats. These are companies that have raised their dividends for over 25 consecutive years.

FAQ: Cheap Dividend-Growth Stocks

The dividend growth investing FAQ section contains answers to investment strategies and cheap dividend stocks questions. It also covers the topic of choosing between dividend yield vs growth.

H3: What are cheap stocks?

Cheap dividend stocks are those that pay dividends and whose market price is below their fair value. However, there is no infallible method for determining fair value. Therefore, investors risk buying a dividend trap rather than a good company with a low valuation.

H3: Is it worth buying cheap dividend stocks?

Cheap dividend stocks with growing dividends are suitable for a long-term strategy aimed at increasing cash flow and capital appreciation. Those with a need for cash income may prefer cheap dividend stocks with high payout yields. However, they should not constitute the entirety of a portfolio.

Which is better: a high yield today, or dividend growth over the years?

When building a well-diversified portfolio, it is advisable to include both types of cheap dividend stocks. The ratio of each type should be determined based on financial goals and investment horizons.

Article Sources

- Morningstar, Inc. (2024). “Morningstar US Dividend Growth Index Methodology.” Morningstar Indexes, detailing index construction criteria including five-year dividend growth requirements, 75% maximum payout ratios, and dividend-weighted portfolio methodology.

- Lefkovitz, D. (2024). “Bots, Barrels, Banks and Biopharma: Dividend Growth Performance Analysis.” Morningstar Indexes Research, analyzing dividend-growth stock underperformance versus technology-led markets and defensive characteristics during market downturns.

- Goldstein, S. (2024). “Specialty Chemicals and Agricultural Inputs Sector Analysis.” Morningstar Direct Research Database, covering Albemarle and FMC Corp fundamental analysis including lithium price recovery expectations and cyclical risk assessment.

- Utterback, J. (2024). “Healthcare Plans and Medical Instruments Equity Research.” Morningstar Equity Research, providing analysis on Humana, Baxter International dividend sustainability and leverage target assessments.

- Sure Dividend Research Database (2025). “Low-Priced High Dividend Stocks Analysis Report.” Sure Dividend LLC, comprehensive analysis of 14 dividend stocks trading under $10 with yields exceeding 5%, including REIT, BDC, and specialty company coverage.

- Ciura, B. (2025). “Monthly Dividend Stocks Valuation Analysis.” Sure Dividend Research, examining cheapest monthly dividend opportunities based on forward valuation multiples and 5-year annualized return projections.

- The Motley Fool Investment Research (2025). “High-Yield Dividend Growth Stock Analysis: Target, T. Rowe Price, Chevron.” Fool.com equity research covering retail, investment management, and energy sector dividend sustainability analysis.

- Morningstar Economic Moat Methodology (2024). “Competitive Advantage Assessment Framework.” Morningstar Investment Management, explaining narrow and wide moat rating criteria for sustainable competitive advantages and dividend growth sustainability.