- In 2025, Coca-Cola’s dividend was $0.51 per share, paid quarterly. The annual dividend per share was $2.04. At the time of writing, the dividend yield was 2.86%, based on a share price of $71.22.

- The Coca-Cola Company (NYSE stock ticker: KO) dividends have grown for 64 consecutive years. Consequently, the company holds the status of both a Dividend Aristocrat and a Dividend King.

- The company has demonstrated high payment stability and a commitment to shareholder interests throughout several economic cycles. KO dividends are a reliable source of passive income.

This article will answer the following question in detail, ‘How much dividend does Coca Cola pay?’, while also discussing the company’s key fundamental indicators and the advantages of Coca-Cola (NYSE: KO) dividends compared to those of its competitors.

Table of Contents

Coca-Cola Dividend Payment Overview

Investors often ask, ‘How much dividend does Coca-Cola pay?’ Here is some detailed data on the company’s shareholder compensation:

- Coca Cola dividend per share – $2.04 for 2025.

- Payment frequency – quarterly dividends.

- KO stock dividend in 2025 – $0.51 per quarter.

Traditionally, Coca-Cola dividend increase occurs in the first quarter of the year. Therefore, it is reasonable to assume that the quarterly dividend paid by Coca-Cola in April 2026 will be higher than that paid in 2025.

Current Dividend Metrics & Calculation

The following formula is used for yield calculation:

Dividend yield = (annual dividend / current stock price) x 100%

Accordingly, Coca Cola dividend yield at the time of writing this review was 2.86% ($2.04 x 100% / $71.22).

This value indicates that, for every $1,000 invested, the investor will receive an annual pre-tax income of $28.60. Taking into account Coca-Cola’s Dividend Aristocrat status and dividend growth rate, investors can expect to receive an additional 4 – 5% each year if they continue to hold the stock.

Payment Schedule & Investor Eligibility

For dividend eligibility, one must purchase the stock before the ex dividend date. This is at least on the previous trading day.

For example, the next dividend payment date for Coca-Cola is December 15, 2025. The nearest Coca Cola ex dividend date is December 1, 2025. This is a Monday, and the NYSE (New York Stock Exchange) is closed on Sundays. Therefore, Friday November 28, 2025 is the last day to purchase the stock to receive the dividend.

In an ideal market, a dividend gap typically occurs on the ex-dividend date, with the size of the gap equalling the dividend amount. In reality, however, the stock price is influenced by many other factors. Consequently, the size of the gap may differ from the Coca-Cola dividend per share.

Dividend Aristocrat Status Explained

In order to be included in the S&P 500 Dividend Aristocrats index, companies must have increased their dividends for 25 consecutive years. The list currently includes 69 companies.

According to BeatMarket, the dividend increase history of the Coca Cola Dividend Aristocrat spans 64 consecutive dividend years.

Coca-Cola’s dividend history demonstrates the company’s financial discipline and effective management of its cash flows.

Historical Dividend Growth Performance

The company has recorded an annual dividend increase for 64 consecutive years (adjusted for stock splits). The company’s complete dividend history dates back 105 years.

A table of Coca Cola dividend growth rates for various time periods is provided below for shareholder income growth analysis.

| Period | CAGR |

| 1Y | 5.22% |

| 3Y | 4.91% |

| 5Y | 3.93% |

| 10Y | 4.75% |

As the table shows, the Coca-Cola dividend increase has been accelerating over the last three years.

64-Year Track Record Analysis

The streak of uninterrupted growth in shareholder compensation by the company spans 64 consecutive dividend years. This payment consistency allowed Coca-Cola to achieve aristocrat qualification.

Coca-Cola’s consecutive dividend years do not guarantee future payments. Even dividend kings can reduce shareholder compensation. Nevertheless, this factor does indicate management’s commitment to investor interests.

Growth Rate Interpretation & Trends

According to Koyfin.com, Coca-Cola’s dividend has increased by 5.22% year on year over the last 12 months. This indicates annualized growth acceleration compared to longer periods. This positive dividend increase trend enhances shareholder returns.

Coca-Cola’s dividend growth rate is within the typical average range for established companies (3 – 6%). The passive income generated by the company’s stock is growing faster than inflation. Therefore, Coca-Cola dividends help to maintain investors’ purchasing power.

Dividend Safety & Sustainability Assessment

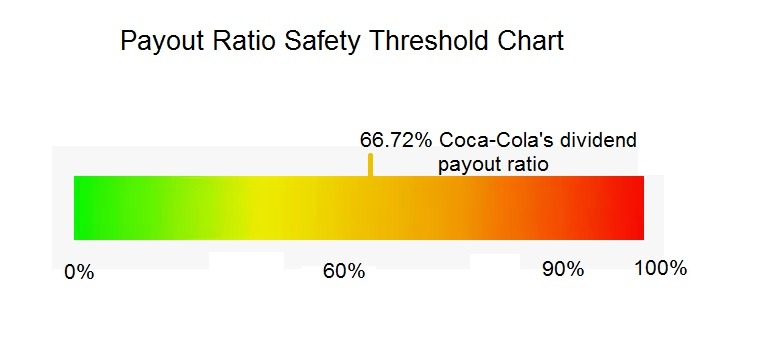

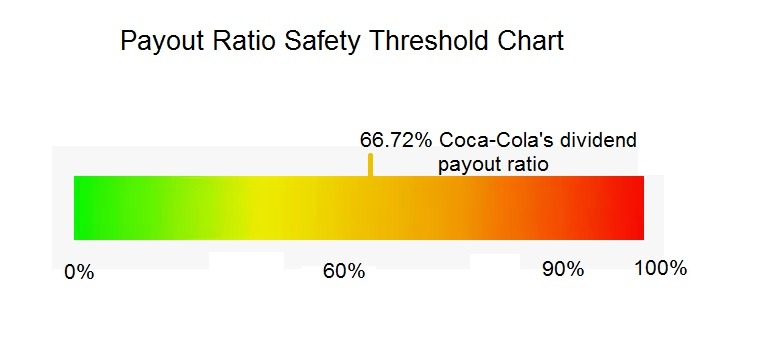

The Coca Cola dividend safety score is high. This assessment is based on the payout ratio and level of earnings coverage. The dividend sustainability is confirmed by Coca-Cola dividend history over several years.

Payout Ratio Context & Interpretation

The Coca-Cola dividend payout ratio stands at 66.72%. This payout percentage is within the safety threshold of up to 80%.

However, it suggests prioritizing the earnings distribution to shareholders over further business expansion. A company with such a payout ratio will not be of interest to investors seeking stocks with high potential for rapid price appreciation.

The Coca-Cola payout ratio indicates that the company is well-placed to maintain its dividend payments and has moderate potential to increase them in the future.

Another positive factor is that the Coca-Cola payout ratio is gradually decreasing against the backdrop of an increasing absolute distribution amount.

Earnings Coverage Analysis

The Coca-Cola dividend per share is expected to be $2.04 in 2025. Meanwhile, according to forecasts from stockanalysis.com, earnings per share will be $3.08. The earnings coverage ratio for dividends is 1.5. This is a sufficiently high value to speak about Coca-Cola dividend safety.

According to finance.yahoo.com, analysts forecast that the free cash flow will triple by 2029. This suggests significant potential for cash generation for shareholders and for maintaining the Coca-Cola dividend growth rate.

Risk Factors & Mitigation

For an income investor, the key dividend risk is the payment suspension risk. Even a Coca-Cola Dividend Aristocrat can reduce or cancel payments. This status indicates past performance and does not guarantee future returns.

However, by 2025, the company will have demonstrated sufficient financial stability to maintain positive momentum. Taking into account the Coca-Cola payout ratio and the company’s earnings forecasts, experts predict that the Coca-Cola dividend growth rate will be sustained in the years ahead.

Total Shareholder Returns Beyond Dividends

Shareholder yield is the total return, which is made up of three components:

- the sum of KO dividends;

- share buyback;

- debt paydown.

The company’s capital allocation is such that the key component of Coca-Cola’s shareholder yield remains the quarterly Coca-Cola dividends.

Shareholder Yield Components

For income investors, the dividend component is the key factor. It accounts for the majority of Coca-Cola’s shareholder yield. As of November 2025, Coca-Cola’s dividend yield was 2.86%.

This is above average for the S&P 500 Index. Thanks to the Coca-Cola dividend aristocrat status, this stock is classified as one of the most reliable securities with an above-average yield.

A share buyback is necessary in order to reduce the number of outstanding shares. This increases the ownership stake of shareholders and enhances capital return. Share buybacks are one of the factors driving growth in earnings per share. It also enables an increase in the Coca-Cola dividend per share.

According to Stockanalysis.com, the share buyback yield is 0.2%. However, KO has shown a moderate increase in this indicator in recent years, rather than debt reduction.

Total Return Performance

Total return is a more important criterion for evaluating investment performance than the Coca-Cola dividend yield. This metric consists of two factors: dividend payments and stock price appreciation. According to Koyfin.com, the 3-month return was 3.81%.

However, price volatility is a normal phenomenon even for dividend stocks. Therefore, it is advisable to evaluate results over a period of 3–5 years or more. According to finance.yahoo.com, the stock’s total return over 5 years was 61.31%. Of this, 38.67% was price appreciation and 22.64% was in the form of Coca-Cola dividends.

Valuation & Investment Context

The forward P/E ratio can be used for stock valuation during investment analysis. This is a multiplier that shows the ratio of the current price to the forecast earnings.

A valuation such as the Coca-Cola forward P/E ratio can help inform purchase decisions based on future results. Meanwhile, the Coca-Cola dividend yield is a metric based on past results.

Forward P/E Interpretation

The forward P/E, or forward earnings multiple, helps assess market expectations regarding a company. Speaking about this valuation multiple in relation to KO, the Coca-Cola forward P/E ratio is 22.3 (according to the Koyfin platform).

The P/E (TTM) ratio is 23.49. This suggests that analysts anticipate growth in the company’s earnings over the next year.

The forward P/E ratio of Coca-Cola falls within the typical range for large US companies. This indicates a fair company valuation.

Income Investor Suitability

Beginner investors often ask, ‘Is Coca-Cola a dividend stock that can generate retirement income?’ The answer is yes. The Coca-Cola dividend aristocrat status makes the company an attractive addition to the dividend portfolio of income investors and retirees.

The company’s stock is ideal for those seeking a conservative investment, for the following reasons:

- high Coca-Cola dividend safety;

- a moderate Coca-Cola payout ratio;

- a lengthy Coca-Cola dividend history;

- a Coca-Cola dividend growth rate that outpaces inflation.

Competitive Dividend Comparison

According to Koyfin.com, Coca-Cola’s dividend yield is higher than 53% of US companies and 58% of global companies.

When assessing the company’s competitive positioning, a general sector comparison is conducted, as well as a peer analysis relative to key rivals. For example, the Coca-Cola dividend vs Pepsi dividend is compared. It is important to compare not only Coca-Cola’s dividend history with competitors’ track records, but also their prospects for future payout growth.

Sector Positioning Analysis

In terms of industry comparison within the beverage sector, the Coca-Cola dividend yield is close to the sector median. According to Koyfin, Coca-Cola’s dividends are higher than 45% of companies in the sector. Investing.com reports that the average sector yield is 3.17%, compared to Coca-Cola’s yield of 2.86%.

What is KO dividend from the perspective of these sector metrics? They are a reliable source of passive income compared to many other dividend stocks.

The proximity of the company’s metrics to average values signals Coca-Cola’s dividend safety and its potential for further payout growth.

Peer Dividend Comparison

Here’s a peer comparison in the table.

| Dividend Yield | Payout Ratio | Aristocrat Status | |

| PepsiCo Dividend | 3.87% | 114.75% | Yes |

| Dr Pepper Dividend | 3.42% | 79.21% | No |

| Procter & Gamble Dividend | 2.88% | 60.60% | Yes |

| Coca-Cola Dividend | 2.86% | 66.72% | Yes |

As can be seen from the table comparing Coca-Cola dividend vs Pepsi and Dr Pepper, Coca-Cola wins in terms of the payout ratio. However, PepsiCo (PEP) and Keurig Dr Pepper Inc. (KDP) surpass it in terms of yield. Another argument in favour of PepsiCo is its greater business diversification thanks to its snack products.

Procter & Gamble (PG) does not produce beverages. However, its stock is a good option for investors seeking alternative dividends in the consumer sector to diversify their portfolio.

How to Invest in Coca-Cola Dividends

Buying KO stock is not only of interest to people seeking retirement income. With a quarterly Coca-Cola dividend of $0.51, it is well-suited to an investment strategy involving dividend reinvestment.

This step enables investors to achieve compound capital growth. Reinvesting increases the number of shares in the portfolio. Consequently, greater passive income is generated.

What is the KO Dividend Reinvestment Plan (DRIP)? It is a plan that automatically reinvests dividends for the company’s direct shareholders, and it is implemented through Computershare.

Dividend Reinvestment Strategy

Dividend reinvestment through a DRIP plan provides not only compound growth of capital. Automatic investing saves time and ensures strict adherence to a regular purchase strategy.

However, Coca-Cola’s DRIP incurs fees for enrollment and maintenance. Therefore, investors would find it useful to compare these terms with those of a broker’s DRIP.

Tax Considerations

When planning cash flow, it is important to consider the KO dividend amount and the associated tax treatment. Dividend tax must be paid in the year the dividends are received. This is independent of whether the funds received were reinvested. The only exception is tax-advantaged accounts, such as an IRA.

Qualified dividends can help to optimize your tax burden. They are taxed at a preferential rate. The amount depends on the investor’s income.

According to IRS guidelines, the rate applicable to qualified dividends may be as follows:

- 0% for low tax brackets;

- 15% for middle tax brackets;

- 20% for the highest tax brackets.

The tax rate on ordinary dividends varies from 10% for those on low incomes to 37% for those on the highest incomes.

Is Coca Cola a dividend stock that pays out qualified dividends? Yes, provided that the investor has met the holding period requirements, Coca-Cola dividends will be considered qualified.

The minimum holding period is 61 days within a 121-day period. The latter’s countdown begins 60 days before the ex-dividend date. Coca-Cola’s ex-dividend date is December 1. Therefore, the 121-day period will run from October 2, 2025 to January 30, 2026.

International investors should bear in mind the issue of withholding tax. Whether they can reduce it and obtain tax benefits in their country of residence depends on whether there is a tax treaty between that country and the USA.

Conclusion: Coca-Cola’s Dividend Investment Case

Here is a brief Coca Cola dividend summary. This company is a dividend aristocrat. The streak of consecutive Coca-Cola dividend years and their growth spans 64 years. The Coca-Cola dividend per share is $2.04 in 2025. The quarterly Coca-Cola dividend is $0.51. The Coca-Cola dividend growth rate is 4.75% (10Y CAGR). The Coca-Cola dividend yield is above average (2.86%).

The Coca-Cola dividend safety is also indicated by a moderate Coca-Cola payout ratio. All of the listed factors make the company’s stock suitable for income investment. However, this investment thesis does not constitute individual financial advice.

Frequently Asked Questions (FAQs)

Q1: Does Coca-Cola offer a dividend reinvestment plan (DRIP)?

Answer: Yes, Coca-Cola offers a dividend reinvestment plan through Computershare, allowing shareholders to automatically reinvest dividends to purchase additional shares without brokerage commissions. This DRIP option enables compound growth as reinvested dividends generate their own future dividends, particularly valuable for long-term investors focused on wealth accumulation. Participants can also make optional cash purchases to incrementally build positions.

Q2: Are Coca-Cola dividends qualified for preferential tax treatment?

Answer: Coca-Cola dividends typically qualify for preferential tax treatment as “qualified dividends” if you hold shares for at least 61 days during the 121-day period beginning 60 days before the ex-dividend date. Qualified dividends are taxed at long-term capital gains rates (0%, 15%, or 20% depending on income) rather than higher ordinary income rates. International investors should consult tax advisors regarding withholding obligations and treaty provisions in their home countries.

Q3: What is Coca-Cola’s expected future dividend growth rate?

Answer: While future Coca-Cola’s dividend increases are never guaranteed. But the historical 10-year annualized growth rate of 4.75% provides a reasonable baseline expectation. The recent 1-year growth of 5.22% suggests potential acceleration, though projecting exact future increases requires management’s assessment of earnings growth, cash flow generation, and capital allocation priorities. The 64-year track record of consecutive increases indicates strong management commitment to maintaining dividend growth.

Q4: How do I ensure I’m eligible to receive the next Coca-Cola dividend?

Answer: To receive the December 15, 2025 dividend payment, you must own KO shares before the December 01, 2025 Coca-Cola ex-dividend date. Shares purchased on or after the ex-dividend date trade “ex-dividend” without entitlement to the upcoming payment. The stock price typically adjusts downward by approximately the dividend amount on the ex-dividend date. Allow settlement time (T+1) when planning purchases to ensure ownership before the ex-date.

Q5: How does Coca-Cola’s dividend compare to PepsiCo’s?

Answer: Both KO and PepsiCo (PEP) are beverage sector dividend aristocrats with 50+ year track records. As of current data, yields typically fall within similar ranges (2.5-3.5%), though specific yields fluctuate with stock prices. PepsiCo’s more diversified portfolio (beverages + snacks) may offer different risk-return profiles. Investors should compare current yields, payout ratios, growth rates, and business model preferences when evaluating these alternatives.

Q6: What does Coca-Cola’s 66.72% payout ratio indicate about dividend safety?

Answer: The 66.72% payout ratio exceeds the conservative 60% threshold often cited by dividend analysts, suggesting KO distributes most earnings to shareholders rather than retaining for growth investments. However, this elevated ratio is sustainable for mature companies with stable cash flows like Coca-Cola. The 64-year uninterrupted payment history validates that KO’s business model can sustain higher ratios without jeopardizing dividend safety, unlike growth companies that require lower ratios for expansion funding.

Q7: What is shareholder yield and how does it differ from dividend yield?

Answer: Coca-Cola’s shareholder yield is a comprehensive return metric combining three cash return mechanisms: dividend payments (KO’s 2.86% yield), share buybacks that increase per-share ownership, and debt paydown that strengthens balance sheets. This composite metric provides a more complete picture than dividend yield alone, as companies may generate superior total shareholder returns through balanced capital allocation across all three components rather than maximizing dividends exclusively.

Q8: Why does Coca-Cola maintain dividend aristocrat status?

Answer: Coca-Cola’s 64 consecutive years of dividend increases qualifies it as a dividend aristocrat – an S&P 500 classification requiring 25+ years of uninterrupted growth. This elite status (achieved by fewer than 70 S&P 500 companies) signals exceptional financial discipline, consistent earnings power across economic cycles, and management’s unwavering commitment to prioritizing shareholder returns. For income investors, aristocrat status serves as a quality filter indicating lower dividend suspension risk.