- According to the definition, a franked dividend is a distribution of earnings for which the tax has already been paid by the company.

- A franking credit is a tax benefit introduced to the Australian tax system in 1987.

- The tax credit was introduced to avoid double taxation and encourage dividend investing.

- The imputation credit represents the amount of duty that has already been paid on a company’s profits. Large companies are subject to a flat tax rate of 30%.

This article will answer the question, ‘What is franked dividend?’, and consider the benefits of franked dividends and their impact on the taxation system of Australia.

Table of Contents

Understanding Franked Dividends

Each shareholder owns a proportion of the company’s business and, therefore, its income. Company profits, from which dividend payments are made, are subject to corporate tax.

Consequently, dividend taxation can lead to double taxation. To avoid this, an imputation system was introduced in Australia in 1987. Under this system, shareholders’ tax is reduced by the tax paid on the dividends by the company.

Whether dividends could be called depends on whether their payer has fulfilled their tax obligations. The possible options are:

- fully franked meaning that tax has been paid on the full amount;

- partially franked (taxation must be paid by shareholders on a portion of the dividends).

Another important factor is the personal tax rate. If this is lower than the corporate tax rate, the investor is entitled to a refunding. Conversely, if it is higher, the investor must pay additional taxation.

How Franked Dividends Work

What does franked mean? It indicates that the recipient of the dividend also receives the right to a taxation credit. Franked dividends work as follows:

- The company pays corporate tax on its profits and then distributes dividends.

- The investor receives a dividend notice. One of the items listed on this document is called a ‘franking credit’.

- The investor completes their tax return for the ATO (Australian Tax Office). They must specify the grossed-up dividend, i.e. the amount paid and the amount of franking credit attached to the dividends.

- The investor is entitled to a tax offset equal to the franking credit. If their tax rate is below 30%, they can also use this amount as a tax offset on other income.

However, in order to be eligible for the credit, the investor must hold the stocks for a minimum of 45 days, not including the day of purchase or sale.

Types of Franked Dividends

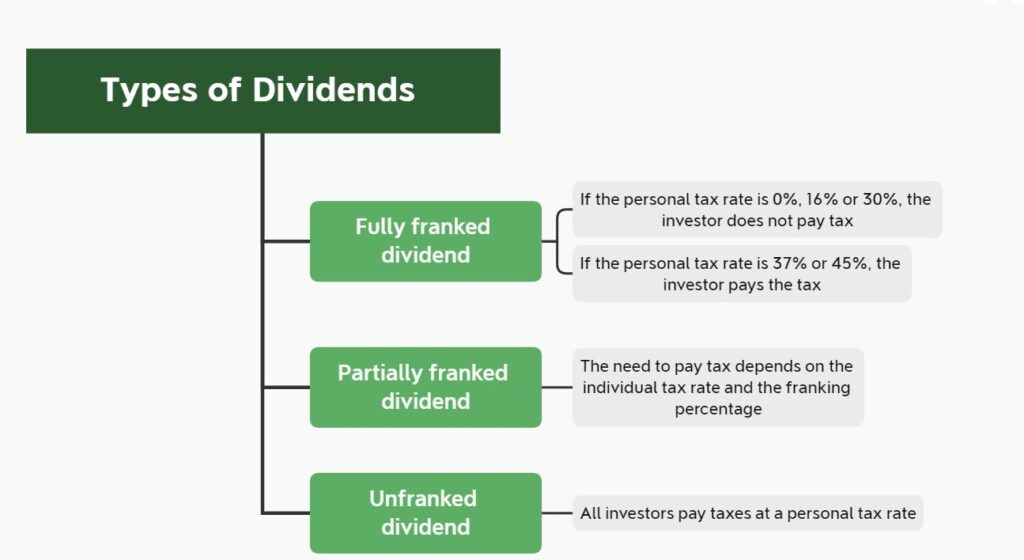

Dividends of companies on Australia can be divided into 3 types:

- A fully franked dividend.

- A partially franked dividend.

- An unfranked dividend.

What is a fully franked dividend? The standard company tax rate is 30%. If a company has paid tax at this rate on all its profits distributed to shareholders, its dividends will be fully franked.

If a company does not make a profit in a given year, it does not pay taxation on income. In this case, it can only distribute an unfranked dividend.

A company can also offset losses from previous years against its current income. This reduces its taxable income. Consequently, the company will pay unfranked or partially franked dividends. The franking percentage depends on the tax paid.

How to Calculate Franked Dividends

The franking credit calculation is done using the following formula:

(Dividend ÷ (1 – Company Tax Rate)) – Dividend

For example, a shareholder received $100. Then the dividend formula becomes:

(100 ÷ (1 – 0,3)) – 100 = (100 ÷ 0,7) – 100 = 142,86 – 100 = 42,86

Thus, the grossed-up dividend is $142.86, and the franking credit is $42.86.

Sometimes it is necessary to calculate the franked dividend and the franking credit, bearing in mind that the company did not pay the full amount of tax. In this case, the result obtained from the above formula is multiplied by the franking percentage.

The final tax calculation must take into account the marginal rate of tax. This determines whether the investor will receive a tax credit or have to pay additional tax.

Tax Implications and Benefits

The impact of franking credit on an investor’s tax liability depends on their personal tax rate:

- a person whose marginal tax rate is below 30% will not have to pay any additional taxes and will be entitled to a tax refund;

- a person with a 30% rate is exempt from paying tax on the dividends received but does not receive additional income tax benefits;

- a person with a rate above 30% must pay additional tax.

Investors with an income tax rate below 30% can use the received credit to offset tax on other sources of income. This improves tax efficiency.

Franked vs Unfranked Dividends

Large public companies usually pay their full corporate tax liability. International companies offer an unfranked type of dividend. As they pay duties in their country of incorporation, they cannot provide a franking credit.

Some investors avoid international stocks due to tax implications. However, such assets have high growth potential. They are essential for achieving portfolio diversification. Furthermore, many international stocks offer attractive dividend yields or good prospects for capital appreciation.

A more flexible investment strategy includes both franked and unfranked dividends. It helps to reduce geographic and currency risks. This should be taken into account when making investment choices.

Benefits of Franked Dividends for Investors

Imputed dividends benefit not only income-focused investors. They also benefit stock markets and society as a whole.

Double taxation reduces tax efficiency and discourages investment in public companies that pay dividends. Consequently, pass-through entities and growth companies that do not pay dividends and instead reinvest all profits in development gain an advantage.

Such assets are more speculative. They are therefore less suitable for retirees’ investment strategies. High stock volatility reduces portfolio stability. Eliminating double taxation increases the popularity of dividend stocks from large public companies. This makes the country’s stock market more stable.

Those who have decided to manage their capital through an SMSF can also benefit from fully franked dividend shares. Earnings from an SMSF are usually taxed at a rate of 15%. Therefore, the tax credit reduces the tax on income received from other assets.

Real-World Example of Franked Dividends

Now, let’s look at a practical example of the tax impact of imputed dividends. Imagine an investor received:

- dividend income of $1,000 (with tax at a rate of 30% already paid by the company);

- interest income from other assets.

Using the dividend calculation formula, the imputation credit is $428.6. The final shareholder benefit depends on their personal income tax rate. In our franking credit example, the impact will be as follows:

- An investor with a 0% tax rate will not pay duties and will receive a return of $428.6.

- An investor with a marginal rate of tax of 16% is exempt from paying tax on dividends received. Additionally, any remaining franking credit will offset some of the tax on interest income.

- If their tax rate is 30%, an investor will not pay tax on the dividends. However, they will pay duty on the full amount of interest income. Nevertheless, the investor must still declare the dividends in their return of taxes.

- Investors with tax rates of 37% and 45% must pay duty on their interest income in full. They will also need to pay additional tax on a franked dividend at rates of 7% and 15%, respectively.

FAQ – Frequently Asked Questions

The main franked dividend questions are discussed below. These cover topics such as tax refunds, SMSF benefits and the effect of an investment portfolio on the dividend yield, as well as the taxation of non-residents.

Can franked dividends affect tax refunds?

Franked dividends provide franking credits. Depending on their marginal tax rate, investors can receive an ATO refund, use the credits as a tax return on other income or reduce the tax payable on dividends.

What benefits do SMSFs receive?

The franking credit provides tax benefits for a self-managed super fund (SMSF) during the accumulation phase. Due to the difference in tax rates (15% versus 30%), the imputation credit can be used to offset tax liability. In the pension phase, however, the tax rate on dividends, interest and capital gains is 0%.

How do non-residents benefit?

International investors who are non-residents cannot claim a return of franking credits on Australian dividends. However, a franked dividend received by them is not subject to withholding tax. Residents of certain countries may be eligible for an income tax offset under tax treaties.

What’s the difference in tax treatment?

An important factor to consider when comparing franked vs unfranked dividends is their respective taxation treatment. The difference between the personal tax rate and the tax rate of the company can reduce an investor’s tax liability on other income. Without a franking credit, investors must pay income tax on the full dividend amount.

How to identify franked vs unfranked dividends on statements?

The presence of a franking credit amount on a dividend notice indicates that the company has already paid tax on that dividend. However, investors must include information about imputed dividends in their tax documentation. The absence of information about a tax credit in the dividend statement indicates an unfranked type of dividend. If dividends are partially franked, shareholder statements will specify the amounts of both types of imputed dividends and the credit amount.

Article Sources

- Australian Taxation Office (2024). “Dividend imputation.” Australian Government, official guidance on franking credits and imputation system for Australian taxpayers.

- Flagship Investments (2024). “Franked vs Unfranked Dividends: Which is Better?” Long-term investing guide comparing tax implications and investment benefits of different dividend types.

- eToro Australia (2025). “A Guide to Franked Dividends.” Investment platform educational resource explaining franked dividend mechanics, tax benefits, and investment strategies for Australian investors.

- Sharesight (2021). “What is a franked dividend?” Stefanovic, S. Portfolio tracking platform blog detailing franked dividend calculations, tax implications, and automated tracking benefits.

- FreshBooks Australia (2022). “What Are Franked Dividends & How Does It Work?” Small business accounting software guide explaining franked dividends for Australian business owners and investors.

- Parliamentary Budget Office Australia (2023). “Dividend imputation and franking credits.” Independent analysis of Australia’s dividend imputation system and its impact on different investor types.

- H&R Block Australia (2024). “What is Franked Income: Understand and Calculate Franking Credits.” Tax preparation service guide on franked dividend calculations and tax return implications.

- Legal Vision (2025). “What is a Franked Dividend vs Unfranked Dividend?” Legal guidance on dividend types, company obligations, and shareholder tax implications under Australian law.