- A dividend ETF (exchange-traded fund) invests in dividend-paying stocks that are selected according to specific criteria. Most dividend ETFs focus on either a high current dividend yield or future dividend growth.

- An ETF’s assets usually consist of over 100 stocks. Each of these generates income for the fund. The ETF pays dividends to the holders of its units from these funds. This usually refers to quarterly dividends. Less frequently, it refers to monthly dividends.

- Holders of ETF units receive diversified passive income, eliminating the need to research and select individual stocks.

- High dividend ETFs have a distribution yield of between 3% and 5%. By comparison, the equivalent figure for the S&P 500 is around 1.1%. This type of asset is therefore in demand for income investing.

This article will answer the question, ‘What are dividend ETFs?’ It will also discuss the nuances of investing for dividend income.

Table of Contents

How Dividend ETFs Work: The Complete Mechanism

Before buying ETF units, it is important to understand ‘How do dividend ETFs work?’ The ETF mechanism essentially comprises two key functions. The first is index tracking. The second is making distribution payments.

The majority of ETFs listed on American exchanges are passively managed. This means that they accurately track the performance of a selected stock market index.

However, active management funds can be found among ETFs. As well as holding stocks in the long term, such ETFs invest in other types of securities and use options.

Now, let’s take a look at how passively managed dividend ETFs work:

- The management company determines which index the ETF will track. This automatically establishes the set of criteria that the stocks in the fund’s portfolio must meet.

- The fund manager creates a portfolio of stocks based on the selected index. If the index changes, the manager rebalances the portfolio.

- ETFs issue units that are traded on an exchange. The price of these units is directly dependent on the value of the stocks held in the fund’s assets.

- The ETF collects dividend income from its stock holdings.

- The ETF pays distributions to the holders of its units from the funds received. This usually occurs on a quarterly basis.

Put simply, an ETF owns a portfolio of stocks, generates income from these stocks, and distributes this income to its investors.

The Role of Index Methodology in Selection

To better understand the logic behind the dividend screening and company selection processes, let’s consider the index methodology, which involves the following eligibility criteria:

- Market capitalization – over $500 million.

- Positive forecast regarding future earnings.

- Dividend payout ratio – less than 100%.

- Payment history – 5-10+ years of dividend growth.

Firstly, all US companies with a market capitalization of less than $500 million are filtered out. The remaining companies are analyzed based on their earnings forecast. For companies with a market capitalization above $500 million that have profit potential, the dividend payout ratio is calculated. Any company with a ratio over 100% is filtered out of the list. From this pool, companies that have increased their dividends for at least five consecutive years are selected.

Distribution Payment Process and Timeline

A key point in the distribution payment timeline is the ex-distribution date. On this date, purchasing a unit no longer grants the right to the upcoming distribution. In order to receive the payment, the transaction must be completed by the end of trading on the last day before the ex-date.

Losing the right to the upcoming payment causes the unit price to drop by the announced distribution amount on the ex-distribution date. For example, if a fund announces a distribution of $1 with a unit price of $200, the unit price will drop from $200 to $199 on the ex-date. However, such a gap would only be clearly visible in an ‘ideal’ market. In reality, stock volatility often affects the unit price more than a dividend payment amounting to less than 1% of the value.

The record date is the day on which the shareholders who will receive the upcoming payment are finalized. Under the T+1 settlement cycle used by all exchanges worldwide, the record date and the ex-date fall on the same business day.

Another important date is the payment date. On this day, the management company transfers the funds from its account.

What Makes Dividend ETFs Different: Distributions vs Dividends

Generally, an ETF distribution includes more than just dividend income. It may account for only 60-70% of the full annual payment. Other possible distribution components are:

- capital gains (up to 25%);

- interest income (up to 10%);

- return of capital (up to 5%).

It is important to understand this nuance because each component has its own tax rules. For instance, qualified dividends are taxed at rates ranging from 0% to 20%. The exact amounts for each component can be found on Form 1099-DIV, which investors receive at the end of the year.

Dividend ETFs vs Individual Dividend Stocks

The main reason for choosing ETFs is the diversification benefits they offer. Buying a unit significantly reduces the risk of portfolio concentration compared to investing in a single company. The table below compares dividend ETF vs stocks based on key criteria.

| Criterion | ETF Unit | Single Company Stock |

| Diversification | Up to 1000+ companies | 1 company |

| Analysis Complexity | Quick selection based on an index | Significant time investment for research |

| Distribution Frequency | Predominantly quarterly | Predominantly quarterly (for US companies) |

| Risks | Lower | Higher |

| Costs | Fund expense ratio (average 0.05% – 0.8%)Trading commissions | Trading commissions |

| Pricing Flexibility | High with moderate volatility | High with stronger volatility |

| Minimum Investment | Price of 1 unit | Price of 1 share |

| Management Features | Passively tracks an index | Requires portfolio monitoring |

Types of Dividend ETFs: Strategy Categories

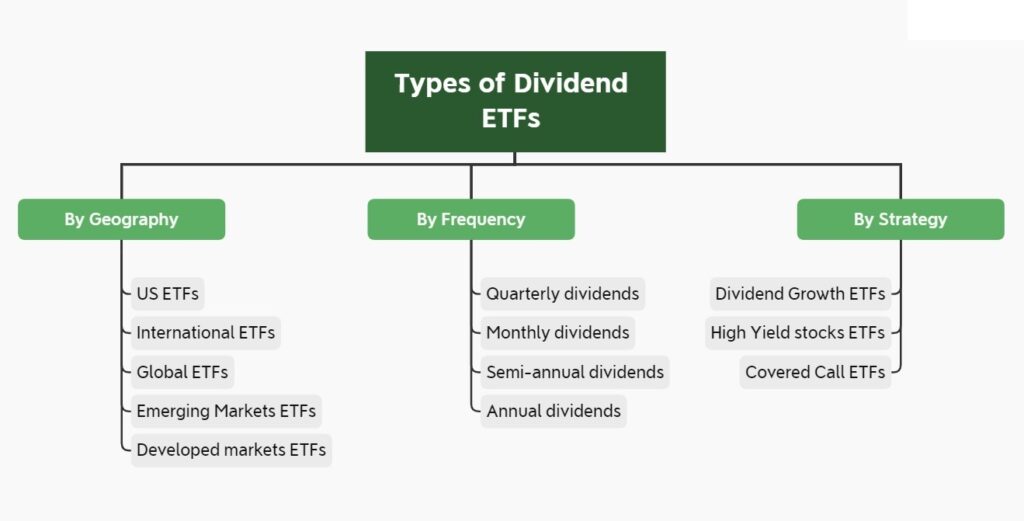

Two main types of dividend ETFs can be distinguished:

- High dividend ETFs. What is a high dividend ETF? These funds invest in stocks with above-average forward yields. One example is the FTSE High Dividend Yield Index. Actively managed ETFs that trade options also fall into this category.

- Dividend growth ETFs. These funds track indices for which consistent dividend growth is one of the stock selection criteria. Examples include the S&P 500 Dividend Aristocrats and the S&P U.S. Dividend Growers Index.

ETFs can also be classified according to geographic diversification. Some funds focus solely on US stocks, while others focus solely on international stocks. The latter can be divided into global, developed market, and emerging market funds.

Another possible classification is by payment frequency. This ranges from monthly to annual payments. However, quarterly dividends are the most common for US ETFs.

High Dividend ETFs: Balancing Yield and Risk

A high dividend ETF that passively tracks a US or international index will provide a dividend yield of 3–5%. ETFs that also trade options can provide investors with a passive income of 4%-7%.

Using an ETF screener, you can find options with yields of hundreds of per cent. However, these are dividend traps. Typically, these are not dividend funds, but rather ETFs that trade in options on cryptocurrency and other volatile assets. Their payments are irregular.

The simple advice for avoiding dividend traps is to apply the same criteria as those used for individual stocks:

- dividend yield of less than 10%;

- dividend payout ratio of less than 100%.

Dividend Growth ETFs: Compounding Income

A dividend growth ETF is a useful tool for inflation protection. It can preserve the purchasing power of passive income.

However, their current dividend yield is lower than that of high dividend ETFs. For instance, the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) has a yield of 2.12%. This fund invests in stocks that have increased their payouts for at least 25 years. Over the past year, the NOBL distribution amount increased by 1.69%. The 10Y CAGR is 8.58%.

Furthermore, such an asset has the potential to deliver higher total returns over the long term than high-dividend funds. NOBL and similar ETFs comprise quality companies. Positive final results are achieved through a combination of high dividend sustainability and capital appreciation.

Understanding Dividend ETF Yields and Returns

To provide a more complete answer to the question: ‘How do dividend ETFs work?’, we will examine the components that make up an investor’s return. Total return is the sum of the distributions paid and the capital gain resulting from an increase in the unit price.

The dividend yield is the ratio of a fund’s annual distribution to its current unit price, expressed as a percentage. In the United States market, a yield below 5% is considered sustainable.

In most cases, a level above 10% is a sign of a dividend trap. This refers to companies that are experiencing financial difficulties and are highly likely to reduce their dividends in the near future.

An ETF pays dividends from the funds it receives from all its assets. Therefore, an ETF’s distribution amount is less susceptible to reduction risk than that of individual companies.

Capital gain is calculated as the difference between the purchase price and the sale price of a unit. The exchange price of a unit depends directly on the value of the fund’s assets. This makes it less volatile than individual stocks.

No passive fund can replicate an index with perfect accuracy. This gives rise to the concept of tracking error. This is calculated as the difference between the ETF yield and the return of the underlying index. This value can be either positive or negative.

Who Should Invest in Dividend ETFs

Income investing in dividend stocks and ETFs is suitable for:

- people seeking retirement income or passive income in addition to their active earnings;

- conservative investors prioritizing stability over capital growth;

- any long-term investors as one of the tools for inflation protection.

Such assets are not suitable for strategies aiming for significant capital appreciation or focused on a timeframe of less than five years. Investors in high tax brackets are advised to purchase assets that provide regular payments in tax-advantaged accounts.

How to Select the Right Dividend ETF

Let’s look at the main ETF selection criteria. Firstly, investors need to decide whether they want an actively managed fund or a passive index fund. If the former, they need to study the strategy that the manager must follow. In the latter case, they need to study the index methodology that the fund tracks. This information is then evaluated from the perspective of:

- geographic diversification;

- asset classes included in the fund;

- sector concentration risk;

- focus on either the size of the payments or their growth potential.

Funds that align with the investor’s strategy, as defined by the above criteria, are evaluated using numerical indicators. The first of these is the expense ratio. The higher the ratio, the lower the investor’s final return. For the cheapest stock funds, this ratio is typically below 0.1%. The second indicator is the amount of assets under management. The size of the fund affects its liquidity.

The matrix below lists additional selection criteria.

| Indicator | Low | Medium | High |

| Dividend Yield | ✓ | ✓ | ✓ |

| Distribution Growth Rate (last 3-5 years) | ✓ | ✓ | ✓ |

| Volatility | ✓ | ✓ | ✓ |

| Morningstar Rating | ✓ | ✓ | ✓ |

Another factor to consider is the frequency of distributions. However, bond funds and actively managed funds typically pay monthly dividends. Focusing too much on this parameter can limit the range of suitable assets.

Risks and Considerations

Dividend ETF risks:

- Sector concentration risk in the index tracked by the fund. The greatest risk arises from a concentration in cyclical sectors. For example, an overrepresentation of the utilities sector is preferable to an overrepresentation of financial sector stocks.

- Risk of distribution reduction. This factor is particularly important for high-dividend ETFs and those with high sector concentration.

- Yield volatility. The ETF’s dividend yield can change under the influence of market factors. Therefore, it is important to regularly review whether further investment in a chosen asset is advisable.

- Price volatility. The price of an ETF unit is directly dependent on the value of its assets.

- Rising interest rates. If this risk materializes, the unit price is highly likely to decrease. This factor has the least impact on dividend growth ETFs.

- Tax inefficiency. Unlike unrealized capital gains, fund distributions increase an investor’s annual income, affecting their tax bracket.

- Focus drift. When pursuing dividend income, investors can lose the balance between growth stocks and high-dividend payers. This can result in a lower total return.

In order to mitigate the impact of the aforementioned risks, effective diversification is necessary. This should be achieved by diversifying across sectors, geography and asset types. Using tax-advantaged brokerage accounts is also important.

The risk matrix is provided below.

| Very Low | Low | Moderate | High | Very High | |

| Very Likely | Yield VolatilityPrice Volatility | Interest Rate Changes | |||

| Likely | Focus Drift | ||||

| Possible | Distribution Reduction | Sector Concentration | Tax Inefficiency | ||

| Unlikely | |||||

| Very Unlikely |

Distribution Reinvestment Plans (DRP)

Distribution reinvestment is recommended for investors in the wealth accumulation phase who do not require cash. This approach leads to the compound growth of capital.

Consider the following example: an initial capital investment of $10,000 with a distribution yield of 3%, excluding unit price appreciation. Without reinvestment, the income from payments would amount to $3,000. However, with quarterly reinvestment over 10 years, the capital would increase to $13,483.49 (before taxes).

Enrolling in a DRP automates dividend reinvestment. This saves individuals time. Furthermore, some brokers and companies allow you to purchase fractional shares and waive trading commissions. All these factors enhance the final return over decades.

Some brokers offer the option to choose a reinvestment percentage. For example, if someone uses dividends to supplement their retirement income, they can choose to reinvest only a portion of the distribution received, rather than the entire amount.

Tax Treatment of Dividend ETF Distributions

The complexity of the ETF tax treatment stems from the composite nature of its distribution. This generally includes the following components:

- Qualified dividends, which are taxed at rates of 0%, 15%, or 20%.

- Ordinary dividends, which are subject to rates from 10% to 37%.

- Long-term capital gains, with rates from 0% to 20%.

- Short-term capital gains, which are taxed at the same rates as ordinary dividends.

- Interest income, which is also subject to ordinary income tax rates.

- Return of capital – not taxed in the year of receipt, but reduces the initial cost basis of the investment.

The dividend tax rate for individual companies and ETF distributions depends on the investor’s total income. The table below provides information on tax brackets for long-term capital gains and qualified dividends in 2025.

| Tax rate 2025 | Single | Married filing jointly | Married filing separately | Head of household |

| 0% | $0 – $48.350 | $0 – $96.700 | $0 – $48.350 | $0 – $64.750 |

| 15% | $48.351 – $533,400 | $96.701 – $600.050 | $48.350 – $300.000 | $64.751 – $566.700 |

| 20% | from $533.401 | from $600.051 | from $300.001 | from $566.701 |

In order for an ETF distribution to be classified as a qualified dividend, two conditions must be met:

- the investor held the ETF units for more than 60 days during the 121-day period starting 60 days before the ex-dividend date;

- the ETF distributes any money it receives as qualified dividends.

Preferential tax rates do not apply to companies that are not liable for income tax. This includes REITs (Real estate investment trust), MLPs and certain financial sector entities, such as BDCs.

Dividend ETFs vs Dividend Mutual Funds

In the debate between ETF vs. mutual fund, ETFs have the advantage. This is primarily due to the pricing mechanism and expense ratio comparison. The only factor that could be used to argue in favour of a mutual fund is that automatic reinvestment is simpler to set up.

The comparison table below is based on key criteria.

| Criterion | ETF | Mutual Fund |

| Pricing Flexibility | Price changes throughout the trading day | Price is set once per day |

| Expense Ratio | Average 0.20-0.60% | Average 0.50-1.00% |

| Tax Efficiency | Higher due to the in-kind redemption mechanism | Lower due to obligations to distribute capital gains |

| Minimum Investment | Price of 1 unit, but some brokers allow trading fractional shares | Can reach several thousand dollars for certain funds |

| Costs | Broker commission Bid-ask spread | Load fees |

| Automatic Reinvestment | Via broker or management company | Via management company |

Getting Started with Dividend ETF Investing

Beginner investors often ask: ‘How to invest in dividend ETFs?’ Here is a step-by-step guide:

- Choose a broker. Pay attention to factors such as trading commissions (many brokers offer these commission-free), stock selection tools, and so on.

- Open a brokerage account online in 10–15 minutes.

- Fund the account. You can do this via wire transfer or ACH, for example. Funds are available the same day or within up to three days.

- Choose an ETF based on the criteria described in the previous sections.

- Place an order to buy: a market order for immediate execution, or a limit order to get a better price.

Investors also need to choose how they want to receive the paid distribution: as cash or via automatic reinvestment through a DRP. Once this has been decided, they will only need to rebalance their portfolio regularly.

Common Dividend ETF Myths and Misconceptions

One of the most common dividend ETF myths is that they are completely risk-free investments. In comparison between dividend ETFs vs. the stocks of individual companies, the price volatility of a unit will indeed be lower. However, there is still a risk of price decline and loss of capital upon sale.

Let’s consider other popular investment misconceptions below.

| Myth | Reality |

| The higher the yield, the better | The rule ‘the higher the yield, the higher the risk’ applies even to ETFs. |

| There is no difference between dividends from individual stocks and ETFs | The distribution of an ETF can include not only dividends, but also other types of investment income |

| The same companies are tracked by all ETFs | The indices that ETFs track can differ in terms of their methodology and composition |

| No taxes need to be paid if dividends are reinvested | Tax is deducted in the year that the income is received, except for income from tax-advantaged accounts |

| ETFs have no growth potential | The unit price increases when the value of the stocks held in the ETF’s assets rises |

Advanced Strategies: Maximizing Returns

Several dividend ETF strategies that can increase the total return on investments are discussed below.

The most important factor is the tax optimization strategy. This involves using tax-advantaged accounts. If an ETF pays the highest dividends, its units are better held in an IRA, a 401(k) pension scheme, and so on. This increases reinvestment efficiency.

Long-term investors may also benefit from diversifying their ETF investments according to their investment strategy. One example of asset allocation is:

- 40% – dividend growth ETFs;

- 40% – high-dividend ETFs;

- 20% – international ETFs.

Another income investment strategy is to allocate funds based on dividend growth. In this case, 50% of the portfolio consists of ETFs with a moderate yield and high stability. A further 25% of the capital is invested in ETFs that focus on achieving rapid dividend growth (CAGR of 7-10%). The remaining 25% consists of funds with a high current dividend yield (4-7%).

If you want to receive monthly dividends, it is advisable to use a strategy based on the distribution schedule. Under this approach, ETFs are selected to ensure that investors receive cash every month.

The yield-focused investment strategy is designed for individuals in the wealth accumulation phase. It involves selecting investment instruments based on current interest rates and yields. For instance, when Treasuries yield 4% or more, investors prefer bonds. At other times, they invest in stock ETFs.

Performance Metrics: Evaluating Your ETF

To ensure dividend sustainability, an ETF portfolio needs to be regularly monitored. The following ETF performance metrics are used for this purpose:

- yield trend (stable or positive);

- distribution coverage ratio (not less than 1.2);

- deviation of the ETF’s yield from its benchmark;

- compliance of the expense ratio with market averages (an optimal value is less than 0.6%);

- level of asset concentration (the percentage of total assets allocated to the top 10 companies does not exceed 30%);

- distribution growth rate (not lower than inflation).

Dividend ETFs and Market Conditions

When developing a strategy, investors must consider key factors such as the interest rate impact and market volatility. Let’s examine how dividend ETFs behave during the various phases of an economic cycle:

- Rising interest rates lead to an increased demand for bonds, which reduces the demand for dividend stocks. This results in a decline in the unit price.

- Falling interest rates make dividend stocks and ETFs more attractive.

- During a recession, ETFs with stable and growing distributions become defensive assets. Those dominated by non-cyclical company stocks also tend to perform well. The utilities sector is a good example of this. However, if an ETF pays the highest dividends, there is a risk of the distribution amount being reduced.

- Periods of economic growth create opportunities for capital appreciation, driven by positive stock price momentum.

- ETFs focused on dividend growth are particularly important for wealth preservation during high inflation. They help to maintain purchasing power.

| Dividend Growth ETF | High Distribution Yield ETF | |

| Rising Interest Rates | ✓ | х |

| Falling Interest Rates | ✓ | ✓ |

| Recession | ✓ | х |

| Economic Expansion | ✓ | ✓ |

| High Inflation | ✓ | ✓ |

Building a Complete Income Portfolio

Consider, for example, an income portfolio that might appeal to an investor with a moderate risk profile.

The asset allocation for dividend income could be as follows:

- Portfolio foundation (50-60%). These are ETFs tracking the broad US market, such as the S&P 500 index (S&P Global).

- A component for future dividend income growth of 20%-30%. These ETFs focus on future distribution growth and track indices such as the S&P 500 Dividend Aristocrats.

- Capital appreciation potential: 10-20%. These ETFs focus on emerging markets and promising, yet volatile, economic sectors.

- A component for increasing current cash flow by 0-10%. These are ETFs with a high dividend yield of 3% or more. Examples include actively managed funds that use options.

However, dividend stocks and ETFs should be viewed as just one part of a wider range of investment options. Portfolio diversification across asset classes involves including components such as growth stocks, bonds, cash, alternative investments and more.

Conclusion: Dividend ETFs as Income Solution

A dividend ETF summary describes it as a fund created for investing in dividend-paying stocks and distributing the income received among the fund’s investors.

Advantages of ETFs for an income investing strategy:

- instant portfolio diversification;

- precise stock selection criteria determined by the underlying index;

- higher dividend sustainability compared to a single company;

- low entry barriers.

In income investing conclusion, it is important to emphasize once again the importance of focusing on cash flow sustainability rather than current yield. This is particularly important for long-term investors and those planning for retirement income.

Investing in ETFs carries risks. The main risks are a decline in the unit price and paid distributions. Therefore, when selecting ETFs, it is important to consider multiple criteria. It is also useful to pay attention to professional ratings, such as Morningstar ratings. However, even a portfolio of the best ETFs requires monitoring at least quarterly.

Another aspect that investors must consider is taxable income and the need to optimize tax payments.

Financial experts recommend that beginner investors use broad-market ETFs. More complex strategies should be adopted once a solid knowledge base has been established, for example after studying educational materials from the SEC.

Frequently Asked Questions (FAQs)

Q1: Do ETFs pay dividends or distributions?

It’s common to say ‘an ETF pays dividends.’ However, it is more accurate to say that an ETF pays a distribution. Generally, unit holders may receive not only dividends but also capital gains, interest income, etc.

Q2: How do dividend ETFs differ from individual stocks?

A portfolio consisting of units from a single ETF is less risky than a portfolio containing shares in a single company. The assets of an ETF usually comprise over 100 companies. Therefore, if one of these companies reduces its payouts to shareholders, the investor’s income will decrease by less than 1%.

Investing in ETFs does not require the analysis of individual company metrics. Consequently, it is more time-efficient than constructing a portfolio of individual stocks.

Q3: Is higher yield always better?

A high yield indicates high risk. For individual stocks, a yield above 10% is considered a sign of a dividend trap, particularly when combined with a dividend payout ratio exceeding 80%.

In the context of a long-term strategy, the growth rate of passive income is more important than its initial amount. Excluding companies with high but unsustainable dividends from the portfolio helps stabilize cash flow and increase total return.

Q4: How are distributions taxed?

The tax treatment depends on the components of the distribution paid by the fund. Qualified dividends and long-term capital gains are taxed at 0%, 15% or 20% rates. Ordinary dividends and interest income, however, are taxed at income tax rates (10%-37%). The amount of each distribution component can be found on Form 1099-DIV.

Automatic dividend reinvestment does not exempt you from the obligation to pay tax in the year the distribution is received. This can only be avoided by using tax-advantaged accounts.

Q5: What to look for when choosing?

When selecting a source of regular income, dividend sustainability is assessed. To do this, you need to look at the payment history and the current dividend payout ratio. Ideally, the latter should be less than 100%. Other important considerations include the fund’s expenses, its Morningstar rating, assets under management and the liquidity of its units.

Q6: What if companies cut dividends?

ETFs offer high diversification. Therefore, if one or two companies reduce their payments, the fund’s distribution amount will only decrease slightly. Such companies may be excluded from the index and the fund’s asset composition in the future. Another argument in the dividend ETF vs stocks debate is that ETFs save time. Investors do not need to monitor the companies in the portfolio or sell those that no longer meet the specified criteria.

Q7: When must I own to receive distribution?

In order to receive a distribution, one must be the owner of an ETF unit on the record date. To achieve this, the purchase must be made no later than the last trading day before the ex-date. For instance, if the ex-date is set for Monday, November 10th, then the final day for purchase is Friday, November 7th. The funds will be credited to the investor’s account on the payment date. This usually occurs 1–2 weeks after the ex-date.

Q8: Should I reinvest distributions?

Most investors are recommended to enroll in a DRP. Reinvesting dividends enables capital to grow at a compound rate. Consequently, the total return increases. However, receiving cash instead of automatic reinvestment is advisable in two cases. Firstly, if a person needs income to cover daily expenses. Secondly, if the investor wants to control the timing of reinvestment and seek the best moments for purchases.