- A Dividend Reinvestment Plan (DRIP) is a program that enables cash dividends to be reinvested automatically into additional shares, including fractional shares.

- Many brokers and companies offer automatic dividend reinvestment at favourable rates. For example, they may offer no trading commission or discounts.

- Dividend reinvestment allows you to build long-term wealth through the power of its compounding effect. Reinvested dividends generate future dividends, allowing you to purchase even more shares. This creates the potential for exponential growth over time.

This article will answer the question, ‘What is a dividend reinvestment plan?’, in detail. It will also examine the advantages, disadvantages, and tax implications for investors.

Table of Contents

What Is a Dividend Reinvestment Plan?

Dividend reinvestment plan definition: A program that enables investors to automatically purchase new shares using dividends received from their assets.

A DRIP helps investors build capital and generate passive income without spending time or incurring additional costs. As the number of shares increases, so does the cash flow. The more money the portfolio generates, the more new shares the investor can buy.

Most US companies offer DRIP programs to their shareholders. Many of these companies use transfer agent services to implement DRIPs. Many brokers also offer automatic stock reinvestment programs.

The terms of a DRIP depend on the organization running the program. Therefore, before enrolling in a plan with a specific broker or company, you should study the offered terms and fees in detail.

How Dividend Reinvestment Plans Work

How does dividend reinvestment work? The DRIP mechanism largely depends on where it is set up. With an issue-sponsored DRIP, the investor receives new shares, including fractional shares, which are provided by the transfer agent. In the case of a broker-sponsored DRIP, the purchase occurs on the open market.

The Automatic Reinvestment Process

The reinvestment process is as follows:

- The company announces the dividend amount and the ex-dividend date. In order to receive the dividend, investors must purchase the shares before the specified day. If they wish to participate in a DRIP, they will usually need to submit an application before this date.

- On the dividend payment date, the funds are transferred to the transfer agent or broker who is facilitating the DRIP.

- The broker or transfer agent uses the funds received to purchase new shares, without involving the investor.

- The new shares are credited to the investor’s account. On the next payment date, the investor receives a dividend distribution based on the increased number of shares.

The key advantage of automatic dividend reinvestment is that it eliminates the need to spend time on transactions. This is particularly evident if the investor owns several dozen stocks that pay dividends four to twelve times per year.

The Fractional Share Advantage

Fractional shares represent a percentage of a single company’s stock or an ETF share. For example, if the dividend amount is $100 and the share price is $157, the investor will receive 0.637 shares. Essentially, the process of buying a fractional share involves the broker purchasing a whole share. The broker then divides this into ‘pieces’ and sells them to clients.

In the USA, the minimum size for fractional share purchases is 0.001 of a share. Partial stock ownership entitles you to receive dividends. However, voting rights at shareholder meetings may be absent or limited.

From a DRIP perspective, the main advantage of fractional share purchases is complete dividend utilization. This improves both economic efficiency and the investor’s final return. Additional benefits of fractional shares include:

- accessibility to expensive stocks;

- portfolio diversification even with small capital;

- convenience when needing to invest a fixed amount.

Issue-Sponsored vs. Broker-Sponsored DRIPs

There are two DRIP types: The first is an issue-sponsored DRIP, and the second is a broker-sponsored DRIP. The key differences between the two are:

- program administrator (transfer agent or broker);

- source of new shares (company treasury or open market);

- liquidity of the acquired assets.

Before making a choice, investors need to study the specific offer from the company and the broker where they hold their account. This will help them to find the most advantageous option. In general, a broker-sponsored DRIP is more convenient for people with a large number of different stocks.

DRIP Types: Issue-Sponsored vs. Broker-Sponsored Programs

Most US companies do not organize a DRIP themselves, but use transfer agent services instead. Therefore, it always involves trading through an intermediary.

For a more convenient DRIP comparison, a table of issue-sponsored DRIP vs broker-sponsored DRIP is provided below.

| Issue-sponsored DRIP | Broker-sponsored DRIP | |

| Administrator | Transfer agent | Brokerage firm |

| Share source | Company reserve | Open market |

| Purchase price | May include 0-5% discount | Market price |

| Commission | Typically $0, but there may be fees | Varies $0-$5 |

| Service fees | $0-10 enrollment $10-25 redemption | Broker-dependent |

| Liquidity | Lower (redeem through agent) | Higher (sell via broker) |

| New investor eligibility | Sometimes with minimum | Usually without minimum |

Issue-Sponsored DRIPs (Company-Run Programs)

How does dividend reinvestment work within an issue-sponsored DRIP? A company DRIP program is administered by a transfer agent.

This is a company that is registered with the SEC (Securities and Exchange Commission) and authorized to provide financial services on behalf of the issuer. EQ Shareowner Services and Computershare, for example, provide transfer agent services in the USA.

The main advantage of an issue-sponsored DRIP is the potential for a share price discount. Some companies offer this to encourage shareholder loyalty.

Another advantage is the absence of brokerage commissions. Also, thanks to fractional shares, it is usually possible to utilize dividends down to the last cent.

A comparison of issue-sponsored DRIP vs broker-sponsored DRIP shows that the former has more disadvantages:

- opening a separate account is necessary;

- account opening and maintenance fees;

- fees when selling shares;

- a minimum initial investment amount (for some companies, it can reach $500).

Broker-Sponsored DRIPs

Enrolling in a broker-sponsored DRIP involves automatic open market purchases. Therefore, transactions occur at the market price. Advantages include higher share liquidity when selling and the absence of a minimum investment threshold.

Furthermore, some brokerage DRIP programs allow you to purchase new shares without paying a commission. Fractional share purchases are subject to the specific broker.

Investor Benefits of Dividend Reinvestment Plans

Key DRIP benefits:

- commission-free investing (in most cases);

- compounding returns, which enhance the effectiveness of a long-term wealth building strategy;

- dollar-cost averaging.

Commission-Free Share Accumulation

Commission-free stock buying provides an investment cost reduction. Traditional brokers and some companies can charge $5–$10 in commissions for reinvesting a single payment. Most online brokers offer no commission DRIP enrolment.

For example, a company pays quarterly dividends and an investor holds its stock for 20 years. During this time, the investor will receive 80 payments. With average transaction costs of $7.50, these could amount to $600.

Compounding Returns Through Reinvestment

Compound interest investing is the most effective long-term wealth-building strategy. The future value of an investment can be calculated using the following formula:

Future Value = Present Value × (1+r)^n, where r is the rate per period and n is the number of periods.

Therefore, the compounding effect over a 30-40 year horizon ensures exponential growth of capital.

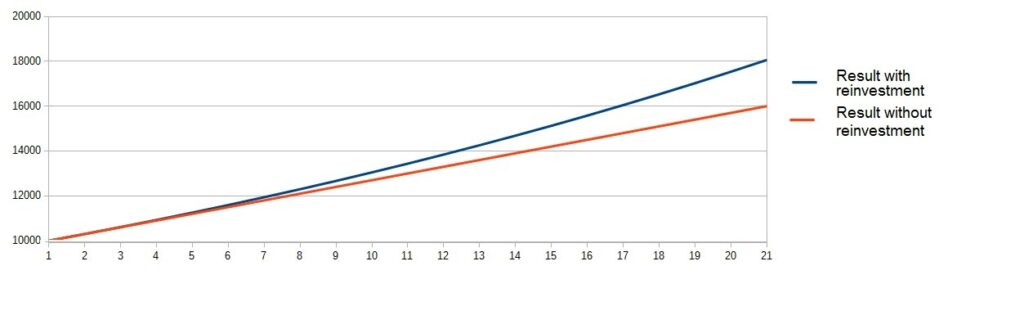

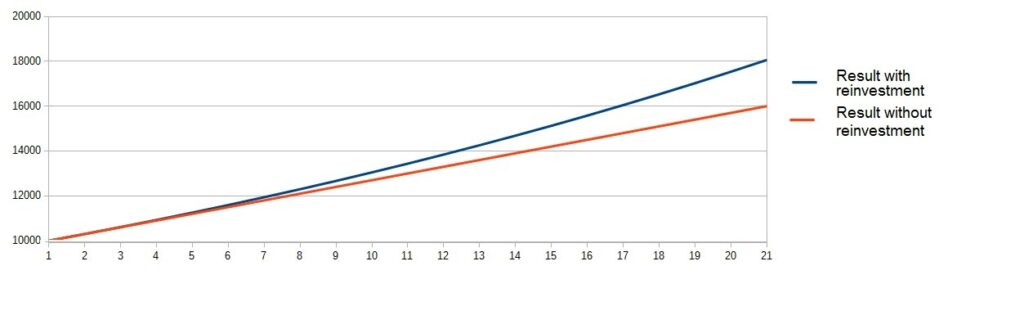

The chart below illustrates the effect of reinvestment compounding.

Assuming an initial capital of $10,000 and a dividend shareholder yield of 3%, the final result after 20 years will be as follows, excluding stock price appreciation:

- $16,000 without reinvestment;

- $18,180 with quarterly reinvestment.

Systematic Dollar-Cost Averaging Benefits

The dollar-cost averaging strategy is the systematic investing of a fixed amount at regular intervals, regardless of the stock price.

DCA investing is necessary for market volatility hedge. During bear markets, the investor buys more shares for the same amount. Consequently, the final cost of the investment is lower than if an equal number of shares had been purchased in both bear and bull markets.

Dividends provide the funds for implementing the dollar-cost averaging strategy alongside an investor’s active income. In addition to cost basis reduction, this method can help to reduce stress levels.

DRIP Performance During Market Volatility

Let’s look at how DRIPs enable dollar-cost averaging. The DRIP strategy during market downturns may seem counterintuitive. However, it is actually a form of opportunistic investing that enables long-term investors to profit from market volatility.

Thanks to DRIP, more shares are purchased at a low price. Therefore, the final profit from the subsequent price increase will be higher. Automating the process ensures strict adherence to the strategy.

Psychologically, it is difficult to invest money in a depreciated asset through manual purchases. This can result in a breach of the dollar-cost averaging strategy protocol.

Tax Implications and Reporting Requirements

Now, let’s consider the DRIP tax implications. Investors receive information about reinvested payments on Form 1099-DIV. However, dividend reinvestment does not exempt one from IRS (Internal Revenue Service) reporting and paying dividend tax.

The rules for qualified dividend taxation are the same as those for cash credited to a brokerage account. Tax-deferred dividend growth can only be achieved through the use of tax-advantaged accounts, such as an Individual Retirement Account (IRA).

One of the tax implications of DRIP investing relates to the cost basis. Any discount received by an investor through an issue-sponsored DRIP is considered taxable income.

Dividend Tax Classification: Qualified vs. Ordinary

According to IRS regulations, qualified dividend taxation is carried out at the rates established for long-term capital gains. In order for dividends to be considered ‘qualified’, two requirements must be met.

The first requirement applies to the payer. They must be a corporation that pays income tax. This means that dividends from REITs and some other companies cannot be classified as qualified.

The second requirement of the qualified dividend taxation rules stipulates that the investor must hold the stock for a certain period. This period must exceed 60 days within a fixed 121-day window. This period begins counting down 60 days before the ex-dividend date.

If one of the requirements is not met, the income received is considered an ordinary dividend. In this case, the dividend tax rate is the same as the income tax rate.

| Tax bracket | Qualified | Ordinary Dividend |

| Low income | 0% | 10% or 12% |

| Middle income | 15% | 22%, 24%, 32% or 35% |

| High income | 20% | 35% or 37% |

Regardless of the type of dividend, investors achieve tax-deferred dividend growth in tax-advantaged accounts.

Cost Basis Advantages and Capital Gains

The DRIP cost advantages essentially come down to the cost basis reduction. This reduction is due to three factors:

- the absence of transaction fees;

- discounts on the market price of the share;

- dollar-cost averaging.

While this can sometimes lead to increased tax liability, in the long term it results in capital gains optimization. The investor’s final after-tax return increases.

Regulatory Framework and Investor Protection

SEC regulated investment programs ensure investor protection. This includes transfer agent oversight and DRIP regulation.

The SEC establishes disclosure requirements and sets rules for the registration of companies that provide transfer agent services. In turn, the IRS sets reporting requirements for dividends and other items. Consequently, the activities of transfer agents within SEC-regulated investment programs are overseen by both bodies.

DRIP Advantages and Limitations

In order to know when to use DRIP and in which situations it will not be beneficial, it is necessary to understand the advantages and disadvantages of dividend reinvestment plans.

The DRIP pros and cons are discussed below.

Key DRIP Advantages

There are 3 key DRIP benefits:

1. Automatic investing advantages, which save time and eliminate the difficulty of making decisions.

2. The option of dollar-cost averaging.

3. Compounding benefits provide exponential growth, but the required investment horizon to achieve this is 20 years or more.

Depending on the terms of a specific DRIP, an investor may receive additional benefits:

- discounts from the market price of the share;

- the right to commission-free stock buying;

- possibility of fractional share purchases.

DRIPs are most advantageous when implemented within tax-advantaged accounts. For example, a 401(k). This allows for tax-deferred dividend growth. This increases the investor’s final return.

DRIP Limitations and Considerations

Key DRIP disadvantages:

- liquidity limitations and potential selling fees for shares obtained through issue-sponsored DRIPs ($10–$25);

- tax implications of DRIP investing: the need to pay tax on dividends from other income sources;

- inability to control the timing of purchases;

- other tax considerations include reporting complications when receiving discounts on shares through issue-sponsored DRIPs;

- deterioration of portfolio diversification and deviation from the target asset allocation.

How to Enroll in a Dividend Reinvestment Plan

Novice investors often ask, ‘How to enroll in DRIP?’ The DRIP enrollment process depends on the program sponsor.

The procedure for joining dividend reinvestment plan for issue-sponsored DRIPs:

- Find information about the transfer agent.

- Request registration documents or complete an online registration form.

- Make the minimum investment required for a direct stock purchase.

- After gaining access to the investor’s personal account, find the section dedicated to dividends.

- Select the DRIP parameters from the available options and save the changes.

Enrollment in a broker-sponsored DRIP:

- If you have a brokerage account, log in to your account. (If you do not have a brokerage account, submit an application to open one.)

- Navigate to the dividend reinvestment settings.

- From the provided list, select the security for which you need to enable DRIP.

- Select the DRIP parameters from the available options.

- Confirm the changes.

DRIP Alternatives and Comparisons

The main investment alternatives that investors choose between are DRIP vs cash dividends. Another option is direct stock purchase plans.

DRIP vs. Cash Dividend Receipt

The choice of DRIP vs cash dividends depends on the investor’s goals. If the dividend strategy is intended for long-term wealth building, automating the reinvestment process offers clear advantages.

When choosing reinvestment vs cash dividends, it is advisable to opt for cash if the investor:

- requires a cash inflow;

- adheres to a market timing strategy;

- plans to reinvest in alternative assets rather than the same securities.

Direct Stock Purchase Plans (DSPPs)

A direct stock purchase plan is an alternative investment program that allows you commission-free stock buying through a broker. To implement it, the business also hires a transfer agent. The benefits of participating in a DSPP depend on the chosen company’s terms. Likely privileges include:

- discounts on shares relative to the market price;

- absence of commissions;

- the possibility of fractional share purchases.

In reality, investors do not need to choose between DSPP vs DRIP. A DSPP is intended for buying new shares with one’s own money. A DRIP is for buying new shares with cash dividends. An investor enrolled in a DSPP can activate an issue-sponsored DRIP.

Conclusion: Building Long-Term Wealth Through Dividend Reinvestment

The DRIP strategy is designed for long-term wealth building. But what is a dividend reinvestment plan for a long-term investor? It saves time and simplifies adherence to the initial purchase plan.

One of the key decisions that a long-term investor must make is whether to choose issue-sponsored DRIP vs broker-sponsored DRIP. This determines the advantages and disadvantages of the dividend reinvestment plan. With issue-sponsored DRIPs, it is possible to purchase shares at a discounted price. However, not all companies offer this privilege.

Other dividend reinvestment benefits include cost basis reduction through commission-free share purchases and fractional shares. But some online brokers also offer these for non-automated purchases.

The DRIP strategy during market downturns offers maximum advantages. During this period, investors acquire shares at a reduced price. This means they can purchase more securities with the same amount of money. This is how DRIPs enable dollar-cost averaging. Making regular purchases during market downturns is one of the most important components of a long-term strategy.

Regardless of its implementation method, the main goal of compound investing is to achieve exponential capital growth. However, this requires a timeframe of several decades.

Frequently Asked Questions About DRIPs

Q1: What is a dividend reinvestment plan (DRIP)?

Answer: A dividend reinvestment plan (DRIP) is an investment program that automatically converts cash dividend payments into additional shares of the same company stock, typically without commission fees. DRIPs enable shareholders to systematically accumulate equity through compounding effect, where reinvested dividends generate future dividends that purchase more shares.

Q2: How do fractional shares work in dividend reinvestment plans?

Answer: DRIPs enable fractional share ownership, allowing investors to purchase partial stock units as small as 0.001 of a share. This ensures complete dividend utilization without uninvested cash remainders. Fractional shares earn proportional dividend payments and voting rights based on exact ownership percentage—for example, 0.5 shares receive half the dividend of one full share.

Q3: Are DRIP dividends taxed even if I don’t receive cash?

Yes, the IRS requires shareholders to report reinvested dividends as taxable income in the year earned, even though no cash is received. Transfer agents issue Form 1099-DIV documenting dividend amounts for tax reporting. The only exception is DRIPs held in tax-advantaged accounts like 401(k)s or IRAs, where taxation is deferred until withdrawal.

Q4: What’s the difference between issue-sponsored and broker-sponsored DRIPs?

Issue-sponsored DRIPs are administered by transfer agents appointed by the company, purchasing shares from company reserves or treasury stock, sometimes at discounted share pricing (0-5% discounts). Broker-sponsored DRIPs are managed by brokerage firms that purchase shares on the open market at current prices without discounts. Issue-sponsored programs typically offer lower fees but reduced liquidity compared to broker-sponsored alternatives.

Q5: How does compounding work with dividend reinvestment?

Compounding occurs when reinvested dividends purchase additional shares that generate their own future dividends, creating a self-reinforcing growth cycle. Each reinvestment period builds upon previous accumulation, producing exponential rather than linear growth. Over decades, this compounding effect can significantly outperform strategies that withdraw cash dividends, especially when combined with stock price appreciation.

Q6: Are dividend reinvestment plans regulated?

Yes, the Securities and Exchange Commission regulates DRIP programs by requiring transfer agents to register and maintain investor protection standards. The SEC mandates transparent disclosure requirements and proper handling of shareholder accounts. Additionally, the IRS governs tax reporting obligations for reinvested dividends. This regulatory framework ensures program legitimacy and protects participant interests.

Q7: Can I enroll in a DRIP if I don’t own shares yet?

Some issue-sponsored DRIPs allow new investors to enroll with an initial minimum purchase, often $250-$500, without owning existing shares. However, many programs require existing shareholder status before DRIP enrollment. Broker-sponsored DRIPs typically allow new investors to participate once they purchase at least one share through the brokerage. Check specific program rules with the company’s transfer agent.

Q8: How do I sell shares purchased through a DRIP?

For issue-sponsored DRIPs, contact the transfer agent to request share redemption, which typically incurs fees of $10-25 and takes several business days. Alternatively, transfer DRIP shares to a brokerage account (sometimes with transfer fees) and sell normally on the open market. Broker-sponsored DRIP shares usually offer higher liquidity, allowing standard market sales through your brokerage platform.

Q9: What are the main advantages of DRIPs for long-term investors?

DRIPs offer commission-free stock buying, fractional share purchases for complete dividend utilization, automatic reinvestment eliminating decision friction, potential price discounts in issue-sponsored programs, and powerful compounding effects over time. Long-term investors benefit most as exponential growth from compounding requires multiple reinvestment periods to maximize returns, making DRIPs ideal for decade-plus investment horizons.

Q10: Should I hold DRIPs in a taxable account or retirement account?

Tax-advantaged accounts like 401(k)s and IRAs are generally superior for DRIPs because they defer or eliminate annual tax obligations on reinvested dividends, allowing full compounding without tax drag. In taxable accounts, you must pay taxes on dividends yearly despite receiving no cash, requiring funds from other sources. However, taxable accounts offer more liquidity and flexibility for accessing funds before retirement age.