Key Takeaways:

- NVIDIA stock investment is a bet on the growth of the technology sector and artificial intelligence.

- The company occupies a strong position in the graphics processing unit market. According to a report published in September 2025, it holds a 94% market share.

- Shareholders receive NVIDIA dividends every quarter. Since June 2024, this has been worth $0.01 per share.

- The expected dates for NVIDIA dividend payments in 2026 are April 1, July 2, October 1, and December 24.

- The main source of income for investors is an increase in the stock price. Today, the NVDA dividend yield stands at just 0.02%.

This article will answer the question, ‘When is NVIDIA dividend paid?’ We will also conduct a dividend analysis from the perspective of crucial metrics and growth potential.

Table of Contents

Current Dividend Data and Key Metrics

When is NVIDIA dividend paid? On October 2, 2025, the company’s shareholders received a payment of $0.01 per share. When will NVIDIA pay its next dividend? The next dividend payment date is December 26, 2025. The amount of the quarterly dividend will be announced on November 19, 2025. The ex-dividend date is set for December 4, 2025.

Key dividend metrics of the company:

- NVIDIA dividend yield – 0.02%;

- annual dividend – $0.04;

- payout ratio – 1.14%.

Dividend History and Growth Analysis

The company has a dividend history spanning 13 years. Throughout this period, it has not reduced its dividend payments. However, the streak of consecutive years of dividend growth is only two years.

When is NVIDIA dividend paid in a larger amount? Over the last 12 months, NVIDIA dividend increases of 42.86% were recorded. The previous dividend increase occurred in 2018.

The dividend growth in 2024 was the result of a stock split. Prior to this, NVIDIA paid dividends of $0.04 per share per quarter. Following the 10:1 split, the company increased its dividend payments to $0.01 per share.

Key metrics of dividend history and growth:

- CAGR 3Y – 28.56%;

- CAGR 5Y – 16.27%;

- CAGR 10Y – 14.84%.

A detailed analysis shows that these high figures are the result of the increased payout in 2024. Therefore, for long-term investors, the question of ‘When will NVIDIA increase its dividend again?’ is more important than the question of ‘When is NVIDIA dividend paid?’

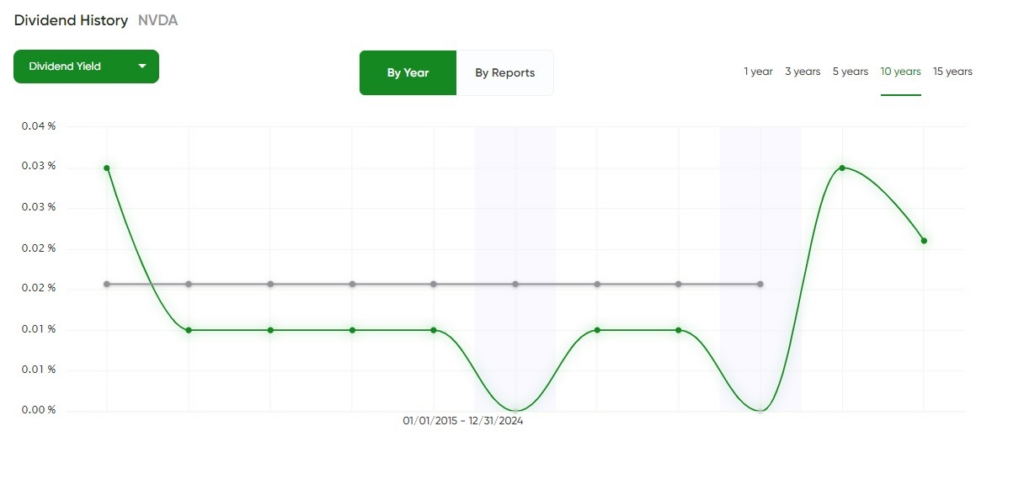

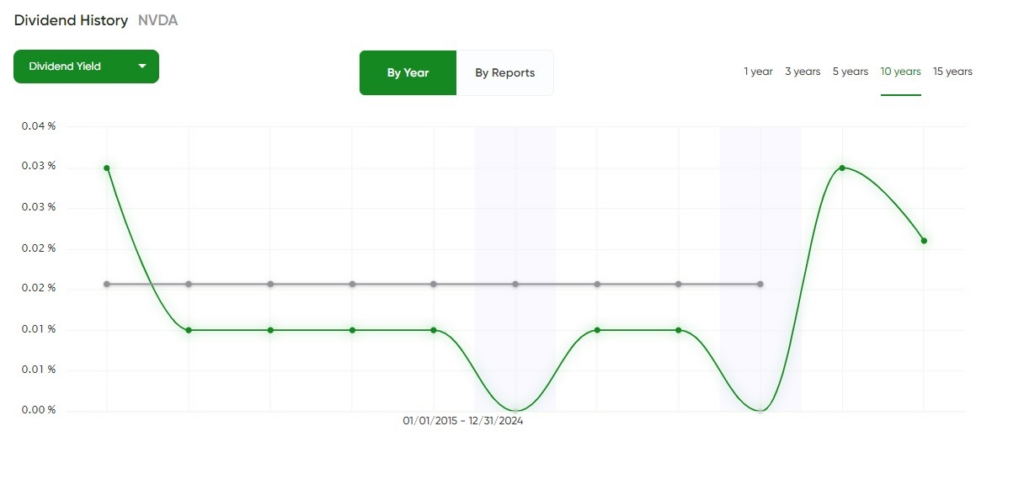

Dividend Yield Analysis and Trends

The company’s historical dividend yield has been low. For over five years, it has been measured in fractions of a percent. This is consistent with dividend yield trends in the sector.

What is NVIDIA dividend, and how does it compare with those of other technology companies? Industry averages stand at a dividend yield of 1.09% and a payout ratio of 21.82%. Therefore, NVIDIA pays significantly less than its competitors.

According to the NVIDIA yield analysis, dividends contribute relatively little to the total return for shareholders. The following dividend yield chart illustrates this change over the last 10 years.

When is NVIDIA’s next dividend payment date and will the dividend yield increase by then? Shareholders will next receive money on December 26, 2025. The payment amount has not yet been announced. However, an increase is unlikely. Even if the stock price falls, the dividend yield will not increase enough to become attractive to investors who live on passive income.

Shareholder Yield and Total Return Components

Stock buybacks contribute only minimally to the total return to shareholders. According to data from stockanalysis.com, the buyback yield over the past 12 months was just 0.99%.

Another component of shareholder yield is debt paydown. Over the past 12 months, the company’s debt level has remained virtually unchanged.

The main way to make a profit from investment in NVIDIA stock is through the difference between the purchase and sale price. Over the past 52 weeks, the company’s market capitalization has grown by 52.72%. According to the consensus analyst forecast, the stock value is expected to rise further.

The answer to the question, ‘Does NVIDIA pay a dividend?’ is yes. However, the company remains unattractive to those seeking passive income. The reason for this lies in the answer to the question, ‘What dividend does NVIDIA pay?’

Dividend Safety and Sustainability Assessment

How much is NVIDIA dividend per share, and what are the risks of a dividend cut? The company currently pays $0.01 per share per quarter. According to BeatMarket, the dividend safety score is 9.5 out of 10, which corresponds to a ‘Very Safe’ level. This conclusion is supported by the following main factors:

- a track record of stable payments spanning 13 years;

- a payout ratio analysis, which is anomalously low;

- expectations of further growth in the company’s revenue and EPS.

NVIDIA has strong earnings coverage of its debt obligations. This demonstrates its strong financial position and high dividend sustainability.

Comparative Analysis: NVIDIA vs Peers and Markets

A dividend comparison with other companies does not favour NVIDIA. According to Koyfin.com, percentile rankings show that NVDA stock generates passive income that is lower than that of 94% of US companies.

A sector analysis shows that, in terms of dividends, NVIDIA outperforms only 8% of companies in the same sector. Its current dividend yield of 0.02% is significantly lower than the industry average of 1.09%.

Peer comparison:

- Advanced Micro Devices Inc (AMD) does not pay dividends;

- Taiwan Semiconductor Manufacturing (TSM) has a yield of 1.14% with a payout ratio of 27.66%;

- Broadcom Inc (AVGO) has 0.7% and 59.07% respectively.

When is NVIDIA dividend paid? It is paid quarterly. TSM and AVGO shareholders also receive cash dividends at the same frequency.

Management Analysis and Capital Allocation Strategy

Since 1993, the position of CEO has been held by one of the co-founders, Jensen Huang. It is estimated that his share ownership is around 3.5%. Despite selling a significant amount of stock in recent years, he remains one of the company’s largest individual shareholders.

The management compensation structure is based on bonuses. Of the total annual CEO compensation of $49.87 million, salary constitutes just 3%. The rest comes from stocks and options.

The main focus of management remains business growth and increasing the company’s market capitalization rather than answering the question, ‘How much dividend does NVIDIA pay?’ This is reflected in the capital allocation between investment in development and shareholder payouts.

Investment Implications for Dividend Investors

How much is NVIDIA dividend for income investors? Compared to the average US company, they represent virtually zero cash flow. It is unlikely that this will be updated to a satisfactory level in the coming years. Such an asset does not align with a dividend investment strategy.

The NVIDIA investment thesis is based solely on the growth of the stock’s market price. Such an asset may be appropriate in a strategy that seeks to strike the optimal balance between future growth vs. income now.

The question, ‘When are NVIDIA dividends paid?’ is not relevant for the company’s shareholders. This is because the ex-dividend dates do not affect the stock price, nor do they lead to a gap due to the extremely low payout amount.

Future Dividend Outlook and Considerations

Prospective shareholders need to consider more substantial issues than the question, ‘When is NVIDIA dividend paid?’ The most important of these is the prospect of future dividend growth.

The company’s earnings depend largely on the AI market impact. However, this factor has a minimal effect on the dividend forecast. The main reason for NVIDIA’s low payouts is that management is focused on further business development. Experts do not anticipate a significant increase in the company’s dividend yield as a result of a potential rise in earnings.

FAQ – NVIDIA Dividend Common Questions

Does NVIDIA pay dividends?

Yes, NVDA pays dividends. A common question from investors is: ‘When is NVIDIA dividend paid?’ The company’s dividend policy provides for quarterly dividends. The most recent NVIDIA dividend payment was made in October 2025.

How much is NVIDIA’s current dividend per share?

Over the past 5 years, the NVIDIA dividend amount has increased by 113%. However, the company has also carried out several stock splits. In 2025, the quarterly dividend per share was $0.01. The annual dividend is $0.04.

When is NVIDIA’s next ex-dividend date and payment date?

When is NVIDIA dividend paid in 2025? According to the dividend calendar, there is only one NVIDIA ex-dividend date scheduled for the end of 2025: December 4, 2025. The next dividend payment date is December 26, 2025. When is NVIDIA dividend paid in 2026? The expected payment dates are April 1, July 2, October 1, and December 24.

Does NVIDIA have sufficient earnings to cover dividend payments?

Earnings coverage indicates high dividend reliability. NVIDIA has an extremely high payout ratio sustainability. It is only 1.14%. The company also has a good dividend coverage ratio based on cash flow of 73 (TTM).

What is NVIDIA’s dividend growth outlook for the future?

Despite the positive AI growth impact on the company’s earnings, the NVDA dividend growth forecast does not predict significant future dividend increases. According to experts, the bulk of revenue will still be allocated to business development.

Article Sources

- Koyfin Financial Analytics (2025). “NVIDIA Corporation (NVDA) Dividend Date & History.” Koyfin.com. Retrieved September 25, 2025. Comprehensive dividend data including yield analysis, payout ratios, growth metrics, and safety indicators for NVIDIA Corporation.

- Simply Wall St (2025). “NVIDIA Corporation (NVDA) Leadership & Management Team Analysis.” Simply Wall Street Limited. Retrieved September 25, 2025. Management compensation data, CEO tenure analysis, and capital allocation strategy under Jensen Huang’s leadership.

- NVIDIA Corporation (2025). “Quarterly and Annual Reports.” U.S. Securities and Exchange Commission Forms 10-K and 10-Q. Official financial statements providing earnings data, dividend payment history, and payout ratio calculations.

- Nasdaq Stock Market (2025). “NVIDIA Corporation Common Stock (NVDA) Dividend History.” Nasdaq.com. Historical dividend payment records, ex-dividend dates, and dividend calendar information for NVIDIA shares.

- S&P Global Market Intelligence (2025). “NVIDIA Corporation Financial Data.” S&P Global Market Intelligence LLC. Normalized financial data used for dividend safety analysis, sector comparisons, and percentile ranking calculations.

- DividendStocks.Cash (2020). “Nvidia stock – Is Mr. Market still buying rationally?” DividendStocks.Cash analytical platform. Historical perspective on NVIDIA’s dividend profile evolution and fair value calculations including adjusted earnings analysis.

- U.S. Securities and Exchange Commission (2025). “NVIDIA Corporation Proxy Statements.” Official SEC filings detailing executive compensation, share ownership data, and management’s approach to capital allocation and dividend policy decisions.